Archives of “June 2019” month

rssUS stock futures climb ahead of the open

Oil companies higher

Lagarde: Eurozone growth has slowed, inflation is low. This requires policy coordination

Comments from the IMF leader

- Risks to eurozone include escalation of trade tensions

- Next EU Commission should come up with incentives for countries to pursue structural reform

- There is a risk the eurozone could slip into a period of low growth and low inflation (isn’t that what we’re in now?)

- Eurozone fiscal rules should be simplified, anchored to debt

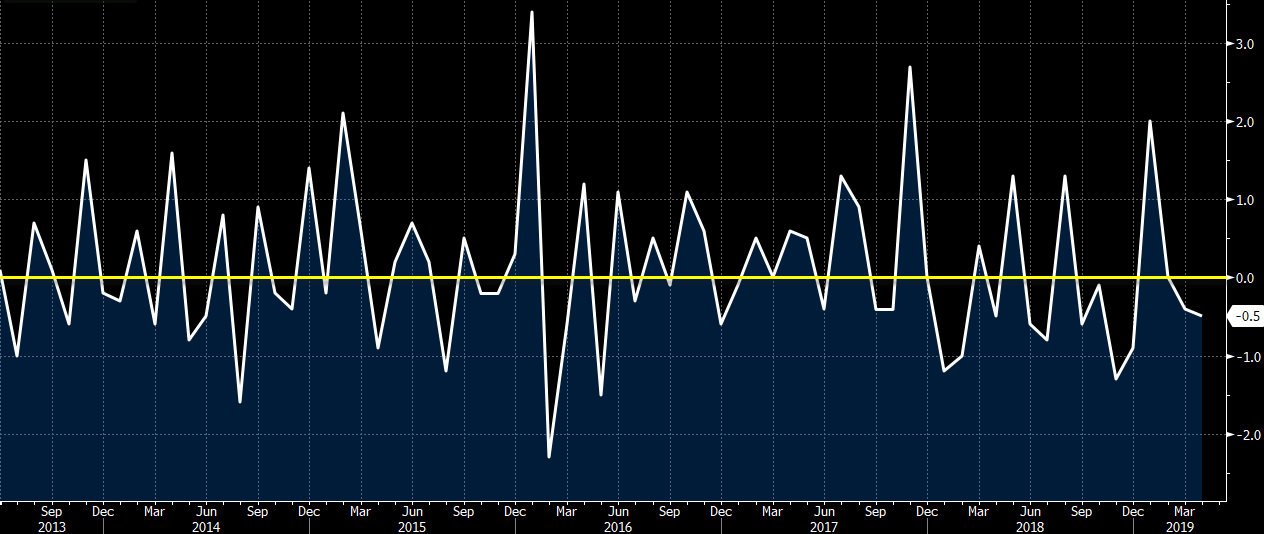

Eurozone April industrial production -0.5% vs -0.5% m/m expected

Latest data released by Eurostat – 13 June 2019

- Prior -0.3%; revised to -0.4%

- Industrial production WDA -0.4% vs -0.6% y/y expected

- Prior -0.6%; revised to -0.7%

Iran on oil tanker attacks: Suspicious doesn’t begin to describe what likely transpired this morning

Iran’s foreign minister, Javad Zarif, tweets

Reported attacks on Japan-related tankers occurred while PM @AbeShinzo was meeting with Ayatollah @khamenei_ir for extensive and friendly talks.

Suspicious doesn’t begin to describe what likely transpired this morning.

Iran’s proposed Regional Dialogue Forum is imperative.

Oil tanker which caught fire in the Gulf of Oman reportedly said to be struck by a torpedo

According to a report by TradeWinds, citing industry sources

It is also being reported that two tankers were caught in the crossfire, not just one, and the crew were forced to evacuate them because of the incident. The headline will only serve to prove that Middle East tensions are still very much present and will continue to act as a tailwind for oil prices as we have seen earlier in the year.

Eurostoxx futures -0.3% in early European trading

Slightly softer tones observed in early trades

- German DAX futures -0.2%

- French CAC 40 futures -0.2%

- UK FTSE futures -0.1%

Nikkei 225 closes lower by 0.46% at 21,032.00

Tokyo’s main index slips alongside Asian stocks on softer risk mood

Tech stocks were the leading losers in the Nikkei today as Japanese stocks fell in general after a poorer performance by US equities in overnight trading.

Since 1993, if you bought SPY on open/sold on close each day, return would be -5.2%, if you did the opposite …

& bought on close/sold on open next day, return would be 568% through 2017

China Daily reports economists expecting cuts to interest rates or RRRs in coming weeks

China Daily is an official English language newspaper owned by Communist Party of China

- To counter “downside risks”

- to maintain liquidity in the financial market

- support infrastructure investment