Gold’s price is similar to summer 2016 levels but trader positioning is only half as net long

Some of America’s biggest companies will have a chance to voice opposition to proposed levies on $300 billion of additional Chinese goods as the U.S. kicks off public hearings on Monday.

The hearings, held by the Office of the U.S. Trade Representative, will span seven days and 320 companies are expected to testify, including retailer Best Buy, footwear and apparel manufacturers New Balance and Kenneth Cole, and the American branch of Chinese TV maker TCL.

Best Buy, which will testify on the first day of the hearings, last month warned of price increases if additional tariffs were put into place.

Last month, tensions in the U.S.-China trade war escalated after the U.S. increased tariffs on $200 billion of Chinese goods to 25% at the direction of President Donald Trump, who also ordered the U.S. Trade Representative’s office to “begin the process of raising tariffs on essentially all remaining imports from China,” valued at approximately $300 billion.

Trump this week threatened to impose these tariffs immediately if Chinese President Xi Jinping skips the G-20 summit in Osaka later this month.

On Thursday, an open letter signed by more than 600 companies, including Walmart, Costco, Target and Gap, urged the Trump administration to hold off tariffs and “get back to the negotiating table” with China. (more…)

The Persian Gulf, a sea as large as the U.K., connects to the more open waters of the Arabian Sea via the Strait of Hormuz, which is just 33 km wide at its narrowest point. Roughly 17 million barrels of crude — enough to meet nearly 20% of global demand — pass through the strait on tankers each day.

Thursday’s attack near the strait on tankers operated by Japanese shipper Kokuka Sangyo and Taiwanese oil company CPC has raised the specter of this crucial sea lane being closed off.

“Iran did do it,” U.S. President Donald Trump told Fox News on Friday. “And you know they did it because you saw the boat,” he said, referring to a video released by the U.S. military which it said showed Iran’s Revolutionary Guards removing an unexploded mine from the side of a Japanese-owned oil tanker.

Iran denies any involvement.

The incident during Japanese Prime Minister Shinzo Abe’s visit to Iran has exacerbated tensions that are already running high in a region of vital importance to the global economy, and especially to a Japan more dependent than ever on Middle Eastern oil.

Turkey’s credit rating has been cut deeper into junk territory by Moody’s Investors Services, with the agency citing its high reliance on external capital flows and rising risk of government default as reasons for the downgrade.

Moody’s cut the country’s long-term debt rating by one notch to B1 from Baa3 and maintained a negative outlook, with the announcement late on Friday prompting a bout of choppiness in the Turkey’s currency, the lira.

The downgrade brings Moody’s in line with Standard & Poor’s rating of B+, which is four notches below investment grade. Fitch’s rating of BB is two notches below investment grade.

Moody’s said the “continued erosion in institutional strength and policy effectiveness on investor confidence” was outweighing positives such as Turkey’s diversified economy and low level of government debt. The inability of political authorities to implement a plan to support the economy remains a key concern. (more…)

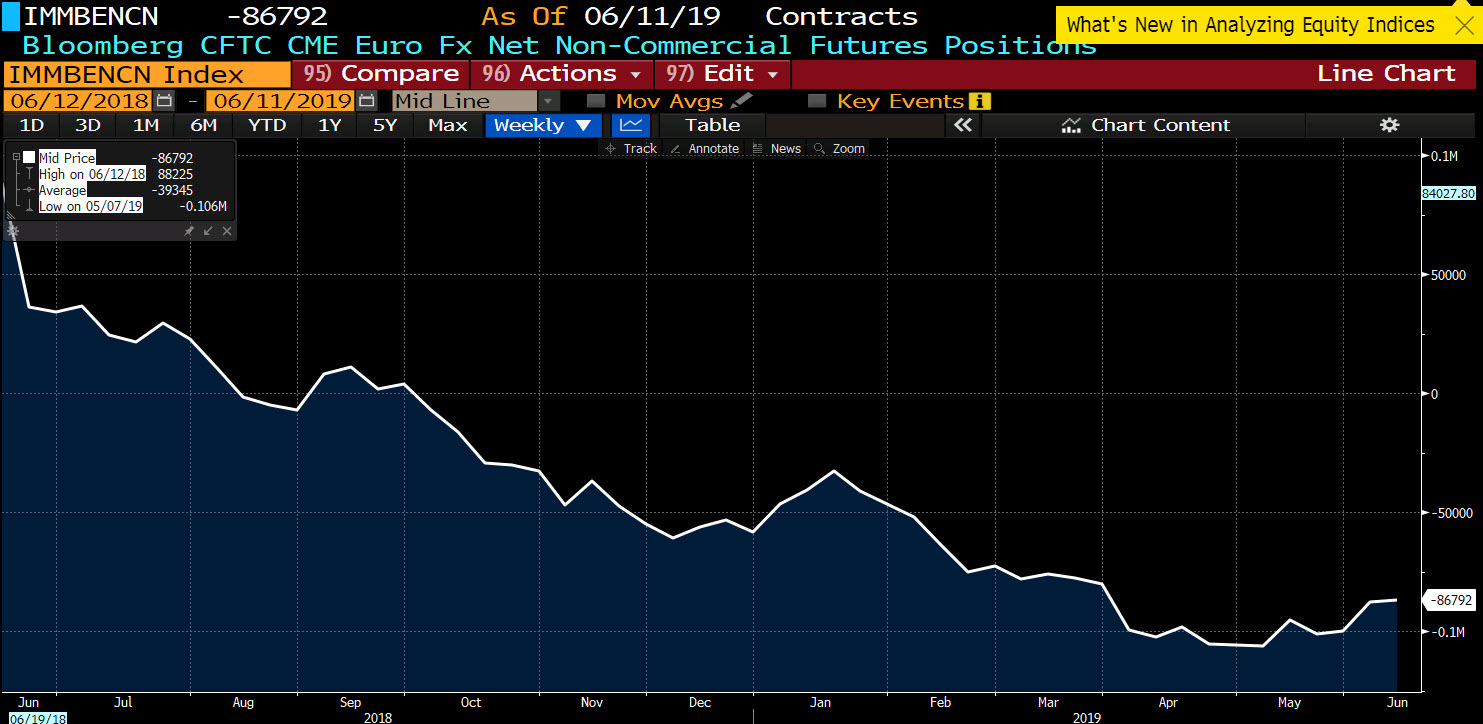

The positions remain long USD (short the currencies).