Adds that Trade tensions are a big factor in slowing global growth

OECD sec gen Knudsen

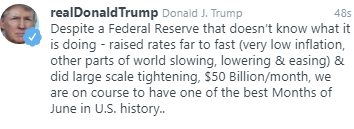

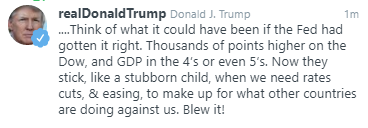

I’ve already given out the NSS award for the day, Captain Obvious will have to do for this guy:

Some gainers today included:

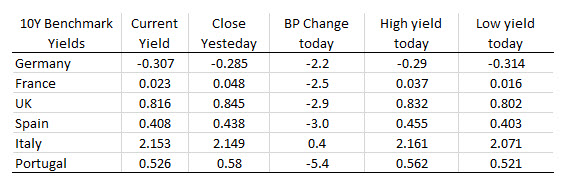

In the benchmark 10 year note sector, yields are ending mostly lower (Italy trades with a small rise in yields). France’s 10 year dipped below the 0.0% level last week, but recovered. Today, the low yield reached 0.016% before rising modestly into the close (to 0.023%).

IN the forex market as London/European traders look to exit, the AUD is still the strongest and getting stronger since the US open). The USD has been overtaken by the JPY and GBP as the weakest of the majors on the day. The GBPUSD reached the highs from June (and peaked a little above those levels) but failed. The price rotated back down.

IN the forex market as London/European traders look to exit, the AUD is still the strongest and getting stronger since the US open). The USD has been overtaken by the JPY and GBP as the weakest of the majors on the day. The GBPUSD reached the highs from June (and peaked a little above those levels) but failed. The price rotated back down.