$INR implied forward yields rise to the highest level since May 2017

I don’t think Iran has a lot of fighting powder to hit back at the US but they probably have mitigating actions to help alleviate pressure from the latest sanctions. The real fear is if they feel emboldened enough to take more military action as what we saw last week when they shot down a US drone over the Strait of Hormuz.

The issue here is that so long as sanctions remain in place, Iran is adamant that they will not negotiate with the US. And that’s leading to rising tensions between the two countries as of late, particularly as Iran has shown that it is willing to strike back after shooting down a US drone last week.

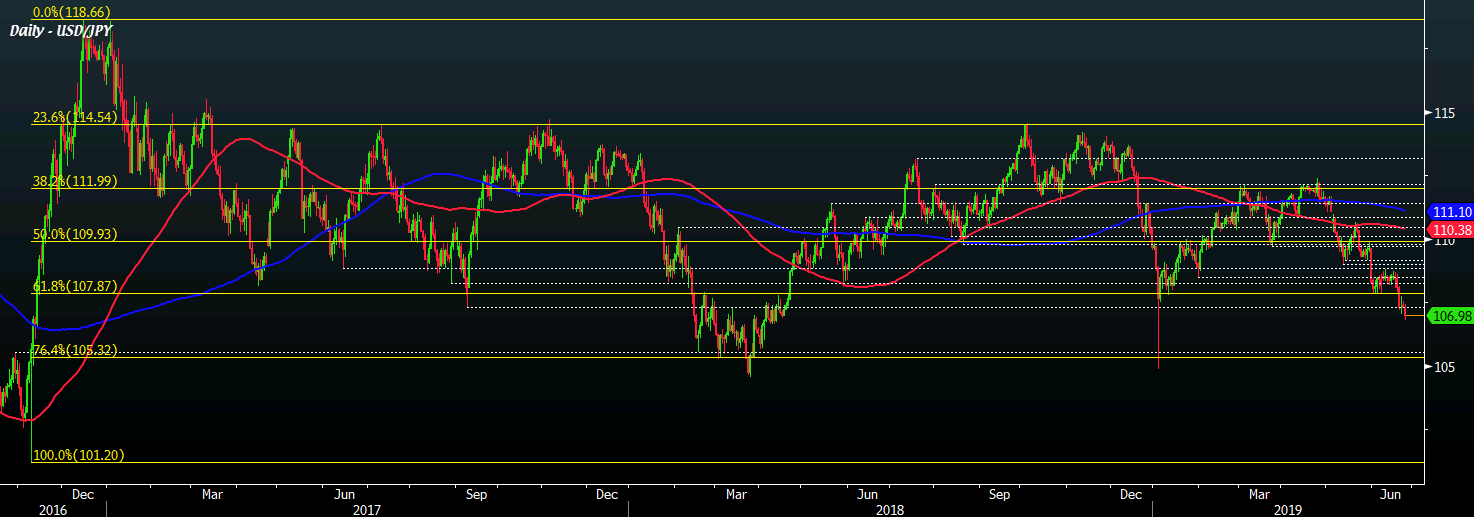

According to the firm’s senior Asian FX strategist, Ken Cheung, they expect USD/JPY to extend its fall towards 104.00 amid dollar strength peaking out while haven demand will help to boost the yen’s allure by the end of this year.

“We expect USD peaking out as rate cut cycle and heightening uncertainties over global recession risk and US-China trade war push safe havens like JPY higher. While the unwinding of long USD positioning before the Fed’s rate cut cycle continued to weigh on the dollar, heightening safe haven demand on JPY given G20 uncertainties and increasing geopolitical tensions in Iran sent USD/JPY below the 107.00 handle.”

And, of course (drumroll please), Chinese President Xi!

Trump to also travel to Korea: