Closing changes for the main indexes

- UK FTSE 100 -0.04%

- German DAX +0.08%

- French CAC -0.3%

- Spain IBEX +0.03%

- Italy MIB -0.25%

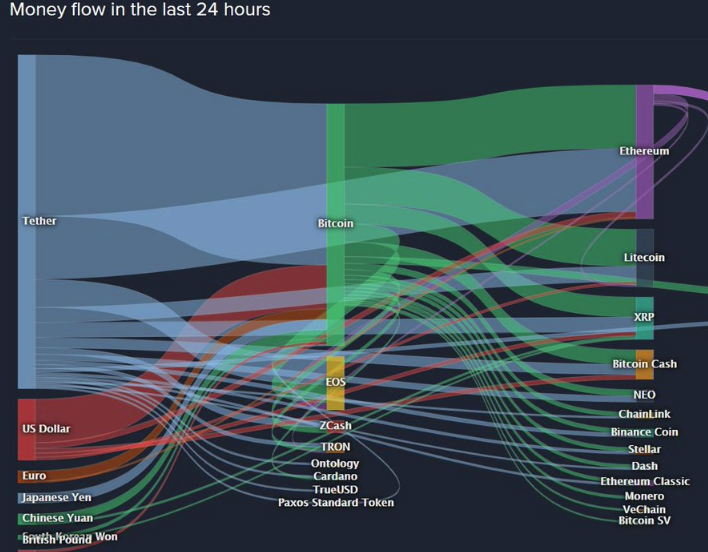

Another interesting tidbit is that even though money is flowing into other cryptos and prices are rising, Bitcoin continues to be the main beneficiary. Bitcoin volumes are higher than nearly all other cryptos combined and its value is over 60% of crypto for the first time since 2017.

API numbers released late yesterday:

That’s the largest one-week draw since Sept 2016 and fifth-largest draw since the series started in 1982. WTI touched $59.93 on the headlines.

The price of bitcoin soared to its highest level since January 2018, as the cryptocurrency’s recent rally shows little signs of fizzling out.

In Asian trading hours on Wednesday, the price of bitcoin traded on the Bitstamp exchange rose as much as 10 per cent to as high as $12,935.58, putting the digital currency on track for its biggest one-day jump in more than a month. Bitcoin’s price pulled back to just under $12,600 in afternoon trading.