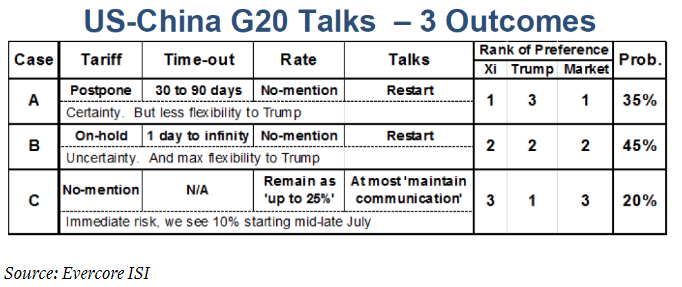

What are the outcomes from the meeting

Evercore ISI believes there are three outcomes for this week’s meeting between Trump and Xi.

The main one is that that Trump announces he will hold off on China tariffs indefinitely and restart trade talks. They see that as a 45% probability.

This would generally be good for markets but the uncertainty about how long talks could go would undermine enthusiasm and lead to more volatility.

A better scenario would be something similar but with a firm timeline, like 90 days. They see this as a 35% probability. This would give markets a chance to “breathe” they say and benefit trade-sensitive sectors.

The final outcome would be no specific mentions of delays on tariffs. They see this as a 20% likelihood and it would stoke fears. It would result in a statement saying something like the two sides would ‘maintain communications’ but would imply more tariffs to come.