Also “if you’re a compulsive gambler, close your terminal”

Another target comes from the daily chart. The 50% of the big move down from the December 2017 high comes in at $11510.44. Like the 50% on the hourly chart, it too will be key for the longer term picture of bulls and bears. It is a big line in the sand that buyers will need to break to keep the run higher. Be aware.

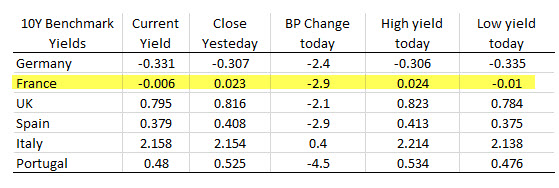

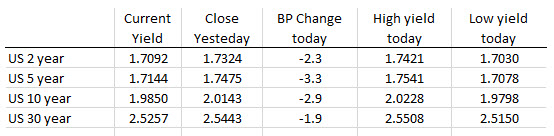

In other markets as London/European traders look to exit are showing:

In other markets as London/European traders look to exit are showing:

In the Forex market the NZD remains the strongest of the major currencies, the GBP remains the weakest. The USD is lower as well with small gains vs the GBP, EUR and CHF.

I don’t think Iran has a lot of fighting powder to hit back at the US but they probably have mitigating actions to help alleviate pressure from the latest sanctions. The real fear is if they feel emboldened enough to take more military action as what we saw last week when they shot down a US drone over the Strait of Hormuz.