Not exactly preaching peace

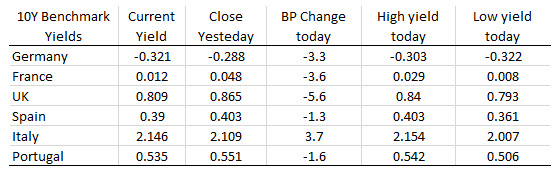

In the benchmark 10 year note sector, yields are mostly lower (with the exception of the Italy BTP).

France’s 10 year yield on June 18th, moved to -0.01% (all time low). Today, the yield dipped to a low of 0.008%. Germany’s 10 year is already negative at -0.321%. Spain is only 39 basis points from going negative. Rates are pushing on a string.

France’s 10 year yield on June 18th, moved to -0.01% (all time low). Today, the yield dipped to a low of 0.008%. Germany’s 10 year is already negative at -0.321%. Spain is only 39 basis points from going negative. Rates are pushing on a string.

Brazil’s central bank kept its benchmark interest rate at a record low on Wednesday, shrugging off pressures calling for monetary stimulus as the economy struggles to recover from a brutal recession.

The bank has held its Selic rate at 6.5 per cent for more than a year against a backdrop of weak economic activity, low inflation and uncertainty over much-needed economic reforms. Brazil’s economy shrank in the first quarter of the year for the first time since 2016, and April and May indicators suggest Latin America’s largest economy continues to limp forward.

Annual consumer price inflation in Brazil fell to 4.66 per cent in May from 4.92 per cent in April, and policymakers expect it to end the year at 3.84 per cent.

Moreover, with investment lagging and the scandal-ridden government of rightwing President Jair Bolsonaro wrestling to pass a crucial pension reform, Brazil’s economy is expected to grow by less than 1 per cent this year, according to a central bank survey.

The monetary policy committee said in a statement on Wednesday that it “emphasises that the continuity of the necessary reforms and adjustments in the Brazilian economy is essential for the reduction of the structural interest rate and for the sustainable recovery of the economy”.

Many local economists feel a catalyst for any changes to the central bank’s policy outlook would be signs of progress on a key pension reform.

Analysts at Itaú said earlier on Wednesday that they expect the bank to maintain the Selic rate stable given the bank’s “unwillingness to change the level of stimulus until there is greater clarity about the prospects for economic reforms — particularly the pension reform. We expect rate cuts to come only after the approval of the reform in the first round of voting in the lower house, which we now expect to take place in July.”

A congressional commission will review the reform package, seen as key to restoring confidence in Brazil’s fiscal position, in June or July. There will then be two votes in the lower house and two in the Senate. The bill could be approved by September, senior lawmakers said, although many analysts believe it won’t happen before the fourth quarter of 2019.

“Going forward, we believe that the combination of weak economic activity with below-target inflation and benign inflationary outlook should open up room for additional monetary stimulus, which would take the Selic rate to 5.0% in 2019, with the policy rate unchanged at this level in 2020,” Itaú added.

The good news for the economy (if you want to stretch) is that the yield curve is steepening with 2s10s up 7 bps and 2s30s up 8 bps. The message here is that the Fed is getting the message that it needs to cut rates.