China’s Iron Ore futures surging over 4% to hit NEW HIGH in five years, breaking through 800 yuan/tonne at one point.

That’s not a particularly large earthquake (especially by Japanese standards) but tsunamis are often about the depth of the quake and other factors.

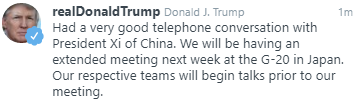

“Had a very good telephone conversation with President Xi of China. We will be having an extended meeting next week at the G-20 in Japan. Our respective teams will begin talks prior to our meeting.”

The amount of negative-yielding sovereign debt is at an all-time high.

Markets are in a state of flux ahead of the Fed tomorrow with the risk mood holding softer in Asia as Treasury yields are notably weaker alongside a more subdued performance in US equity futures to start the day.