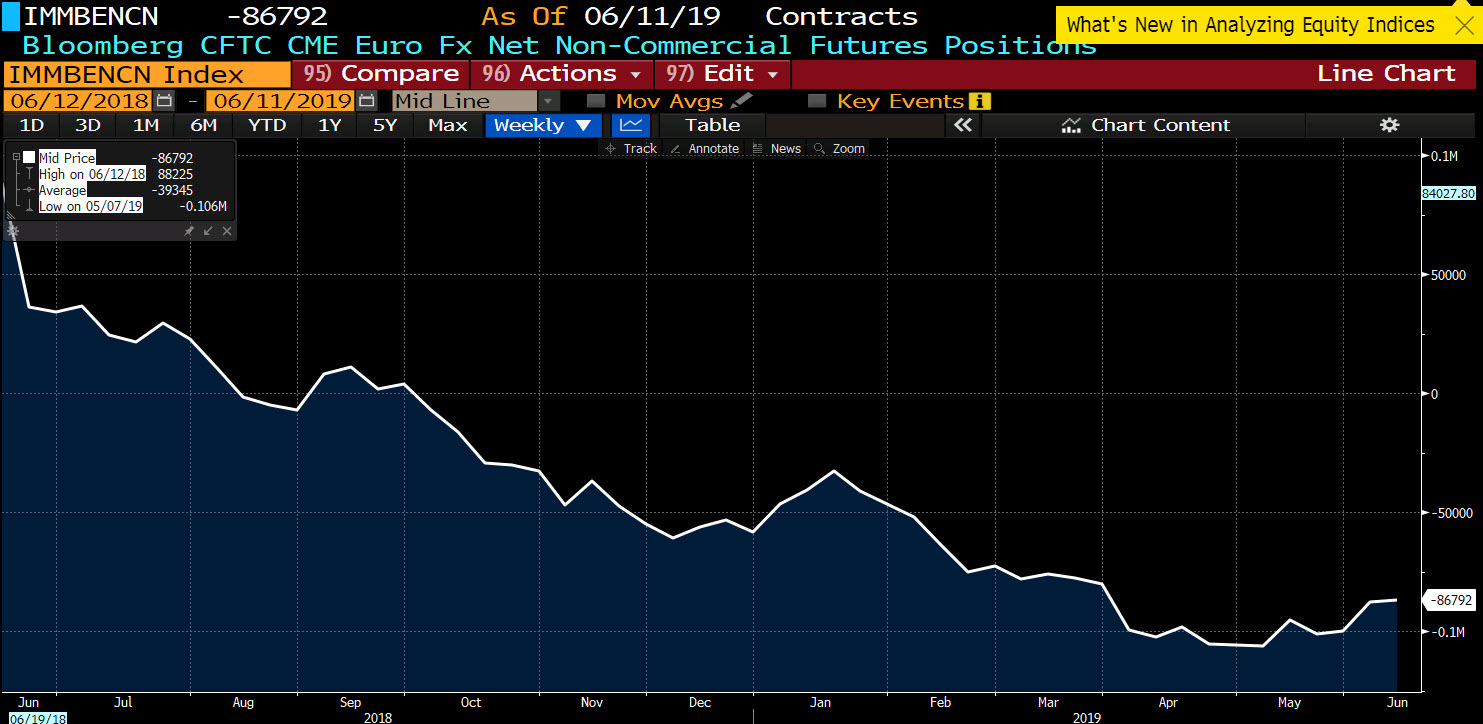

Weekly Forex futures net noncommercial positioning data for the week ending June 11, 2019

- EUR short 87K vs 88K short last week. Shorts trimmed by 1K

- GBP short 45K vs 48K short last week. Shorts decreased by 3K

- JPY short 45K vs 44K short last week. Short increase by 1K

- CHF short 25k vs 36k short last week. Shorts decreased by 11K

- AUD short 63k vs 63k short last week. Unchanged

- NZD short 16K vs 20K short last week. Shorts decreased by 4K

- CAD short 33K vs 42K short last week. Shorts increased by 9K

- Prior week

The positions remain long USD (short the currencies).

The CHF shorts decreased by 11K

The CAD shorts were increased by 9K.

The CAD shorts were increased by 9K.

Those were the biggest movers in the week.