Not even strong data can shake the faith in rate cuts

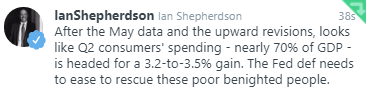

Once upon a time economic data mattered. Now the market is so confident it can bully the Fed into rate cuts that an outstanding retail sales number hardly dents the faith.

Fed fund futures now peg the chance of a July 31 rate cut at 88%, down from 89% before the data. US 2-year yields have ticked fractionally higher but remain on the floor.

US equity futures remain flat.

Granted, if the Fed signals cuts next week it will be more about trade risks and the future than what’s currently happening in the economy. But what’s currently happening is record low unemployment, record retail sales and sky-high consumer confidence.

There are small signs of weakness but there are always small signs of weakness. Inflation is low but it’s been low forever. If you take away what’s been happening in financial markets and politics then the Fed wouldn’t even be dreaming about cutting.

For years the Fed loved to say it was data dependent. That was a lie.