Tokyo’s main index slips alongside Asian stocks on softer risk mood

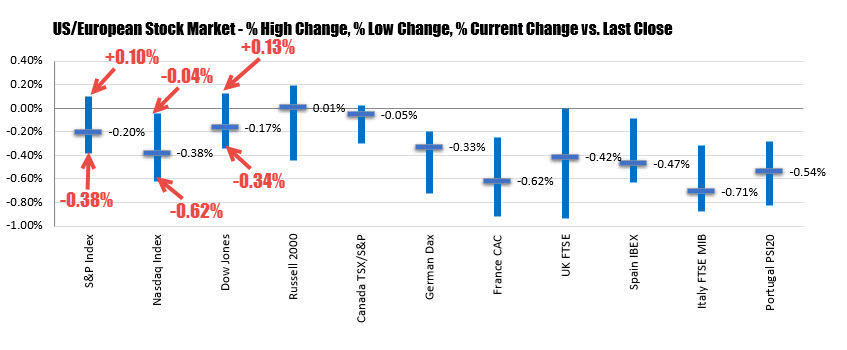

Tech stocks were the leading losers in the Nikkei today as Japanese stocks fell in general after a poorer performance by US equities in overnight trading.

Lingering global trade tensions and continued protests in Hong Kong isn’t helping with sentiment in the region but also the fact that US equity futures are down by 0.2% won’t help to alleviate the risk mood to start the European morning.

The yen is bid as a result though gains are more measured compared to what they were in early Asian trading. USD/JPY holds at 108.36 currently, off the lows earlier at 108.17.