Closing changes for the main European bourses:

- UK FTSE 100 +0.4%

- German DAX +0.5%

- French CAC +0.6%

- Spain IBEX -0.1%

- Italy MIB +0.2%

Russian gas giant Gazprom on Monday became the country’s top publicly traded company by market capitalisation after its shares shot up to their highest level since 2008, driven by a new dividend policy.

The state-owned company’s shares rose 12 per cent on Monday morning from Friday’s close, peaking at Rbs241.65 ($3.68) per share on the Moscow Stock Exchange. This spike raised Gazprom’s market capitalisation to Rbs5.62tn, putting it ahead of Sberbank, the country’s top lender.

Gazprom’s shares have risen sharply since mid-May, when the company recommended more than doubling dividend payments compared with the previous year to Rbs16.61 per share. The news pushed the company’s capitalisation to make it the second most valuable company on the exchange at the time.

Last week, the head of Gazprom’s finance department, Alexander Ivannikov, said the company was working out a new dividend policy, where it will strive to bring its dividend payments up to 50 per cent of net profit within three years, and pay no less than 27 per cent of net profit in the meantime.

The stock rose ahead of Gazprom’s board meeting scheduled for Tuesday.

Treasury yields added to their steep decline from May, with the benchmark 10-year note falling below the 2.10 per cent mark for the first time since September 2017 as President Donald Trump’s tariff threat against Mexico further rattled investors who are already on edge over renewed US-Chinese trade tensions.

Growing fears that Washington’s disputes with its biggest trading partners will hobble global economic growth have intensified expectations that the Federal Reserve will cut interest rates sharply this year.

In response, nervous, haven-seeking investors sent the yield on the 10-year paper down as much as 5.5 basis points on Monday to 2.0693 per cent — a near 21-month low. This comes on the heels of a 38 bps decline for the 10-year yield in May, the biggest monthly drop since January. Yields move in the opposite direction to price.

Yield on the more policy-sensitive two-year note was down as much as 8.2 bps to a fresh 18-month low of 1.8397 per cent. The 30-year yield fell 4.8 bps to 2.5204 per cent, a level not seen since November 2016. Other haven assets, including gold, also rallied on Monday while US stocks are set for another bruising session.

Mr Trump’s move to impose escalating tariffs on Mexican goods unless the country agrees to help curb migration from Central America shocked markets, and analysts at JPMorgan Chase believe the growing risk-off sentiment could push Treasury yields down further still. The bank now sees the 10-year yield down at 1.75 per cent by the year-end, compared to its prior forecast of 2.45 per cent.

“Even before the news on Mexico, downside risks to the economy had been building,” said the bank in a note to clients on Friday. “The latest developments this week are likely to have lasting damaging effects on business confidence and should thus prompt the Fed to respond.”

It is now pricing in a 43 per cent chance of a recession over the next 12 months and expects the Fed to cut interest rates twice this year.

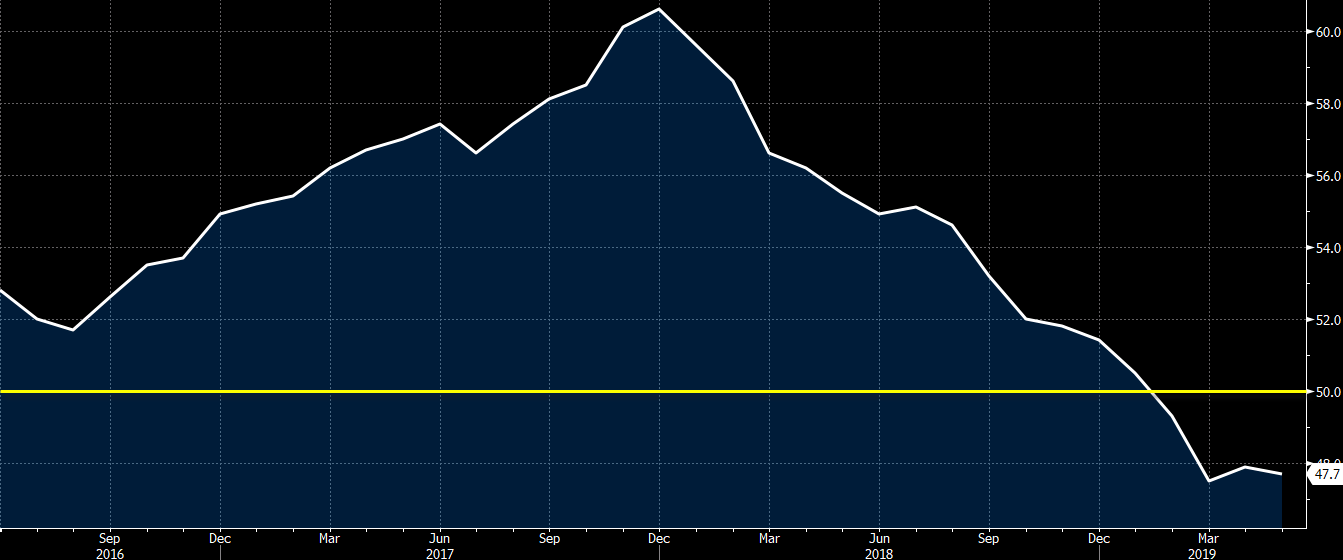

The downbeat view was echoed by Morgan Stanley. which warned on Monday that the US market cycle has shifted from an expansionary phase to a “downturn” for the first time since 2007.

Underscoring the uncertainty sparked by the escalating trade war, bond volatility surged to an over two-year high on Friday. The Merrill Lynch Option Volatility Estimate (Move), a widely-watched measure of expected price swings in US Treasuries over the coming month, jumped to just below 73, its highest since April 2017 and two months after hitting a record low in March.

The tweet reads:

“China is subsidizing its product in order that it can continue to be sold in the USA. Many firms are leaving China for other countries, including the United States, in order to avoid paying the Tariffs. No visible increase in costs or inflation, but U.S. is taking Billions!”

Bond yields are on the move once again it could be related to this headline here. Jitters and nervousness surrounding global trade tensions still remain and that’s weighing on markets as we begin European morning trade.

The tweet reads:

“Based on information I received, China will issue a warning on the risk of studying in the US. This warning is a response to recent series of discriminatory measures the US took against Chinese students and can also be seen as a response to the US-initiated trade war.”