Why we build wealth and live below our means:

20 yrs: Switzerland 10 yrs: Germany, Japan, Denmark, Netherlands 8 yrs: Austria, France, Finland 7 yrs: Sweden, Belgium 6 yrs: Ireland, Slovakia 5 yrs: Spain, Portugal, Slovenia 3 yrs: Malta, Bulgaria 6 mo: Italy

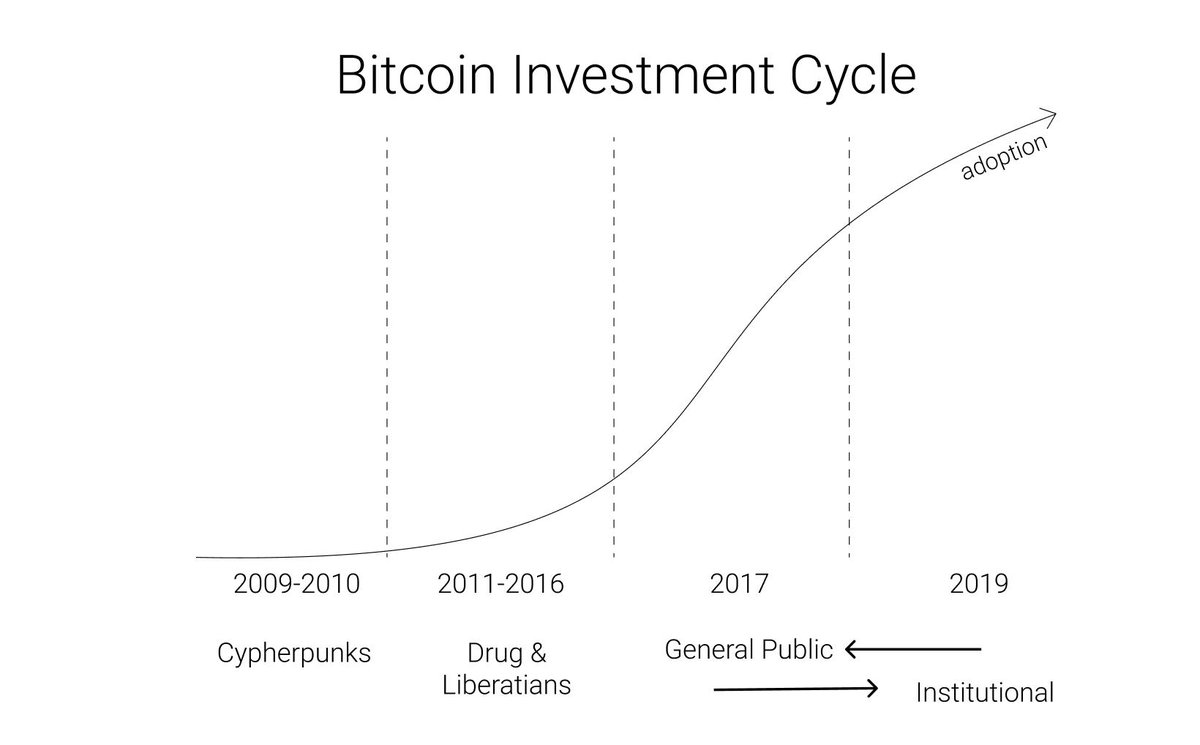

It’s an insiders game. From founders to accredited angel investors… Then to the VCs, the institutional money… …and finally after the first 1000x has already happened, the public get to invest.

The founders were the cypherpunks. The angel money was from drugs and libertarians. Then came the general public. Institutional money comes last. The rules of investment (or lack thereof) favoured the public. Welcome to Bitcoin. 1000x for the public

Investors will continue to keep an eye on trade developments and their impact on markets, but Donald Trump’s visit to the UK, monetary policy from a number of central banks and Theresa May’s resignation are other notable events on the calendar.

Here’s what to watch:

Trump’s UK visit

President Trump will be hosted by Queen Elizabeth II on a state visit. He is also expected to meet outgoing prime minister Theresa May. The visit may also provide an opportunity for Mr Trump to threaten to limit intelligence-sharing with Britain if the UK government lets Chinese telecoms group Huawei build part of the 5G network.

Widespread protests are expected in the UK. The Stop Trump Coalition — formed ahead of Mr Trump’s last UK visit — is planning a “noise protest” involving pots and pans outside Buckingham Place during the banquet.

US employment

The labour market remains one of the bright spots for the US, which was seen a mixed batch of data in recent weeks. Economists expect the world’s biggest economy to have added 183,000 jobs in May and for the unemployment to remain steady at a historically low level of 3.6 per cent.

Other US economic data this week include: factory orders on Monday; private sector payrolls, services sector activity and the Federal Reserve’s so-called “Beige Book” on Tuesday and; trade balance on Thursday.

European Central Bank (more…)

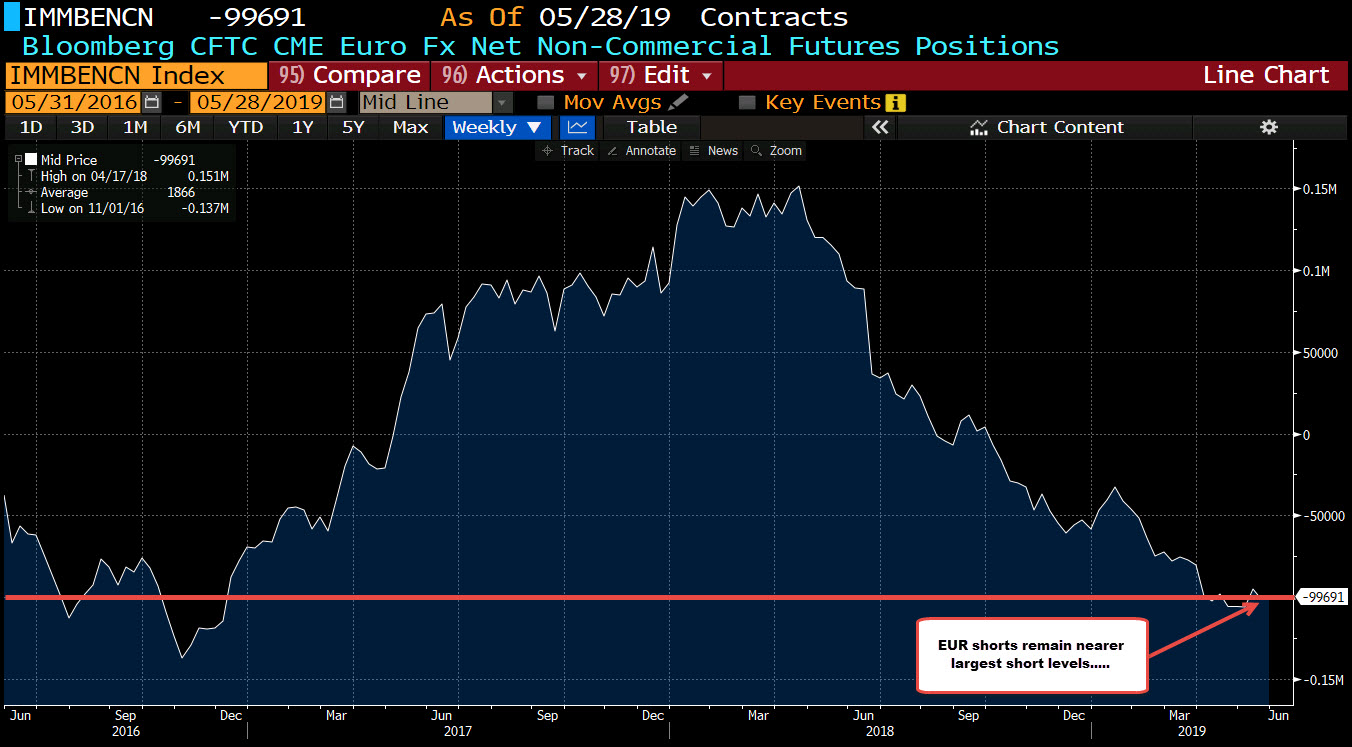

Minor wiggles in positions this week although the GBP shorts increased by an additional 6K after increasing 23K last week. AUD shorts remain healthy on expectations of cut(s) in rates. The largest position remains the EUR as speculators don’t like the prospects for the common currency.