Bloomberg Commodity Index a break of 77.83 would signal acceleration to test record low ~72.50

Non -manufacturing (services) Purchasing Managers Index (PMI), 54.3

Composite Purchasing Managers Index (PMI), 53.3

On the manufacturing PMI, not only did it come in a sharp drop on the month and below the central estimate, it also came in below all estimates (from the Bloomberg survey). Its a terrible result.

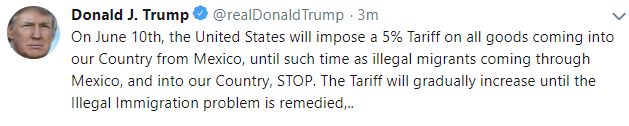

Adds in the next tweet:

Adds in the next tweet:

US and European equities rebounded on Thursday but were still heading for their biggest monthly decline of the year as concerns have mounted over a global slowdown in the face of an intensifying US-China dispute over trade.

The S&P 500 finished 0.2 per cent higher, bouncing from its lowest close since early March, but having swung from gains of as much as 0.6 per cent to a decline of as much as 0.2 per cent.

The yield on the US 10-year Treasury note was down 1.9 basis points at 2.2168 per cent, having dropped sharply on Wednesday to their lowest level since September 2017. Bond yields fall as their prices rise.

Europe’s benchmark Stoxx 600 climbed 0.4 per cent on the penultimate day of the month from its lowest close since March 25. The index has fallen nearly 5 per cent in May, heading for its worst month this year. London’s FTSE 100 was down 0.5 per cent, easing off its lowest level since May 13.

Conflicts over trade and technology between the US and China have shown no signs of abating while expectations of slowing growth in the world’s biggest economies have mounted. Brazil’s economy meanwhile contracted for the first time in more than two years.

Latin America’s largest economy shrank in the three months to March for the first time since 2016. Gross domestic product fell 0.2 per cent in the first quarter, the first quarterly contraction since the final three months of 2016. The Brazilian real was 0.1 per cent weaker, with $1 buying BRL3.9786. (more…)