Economists see cuts

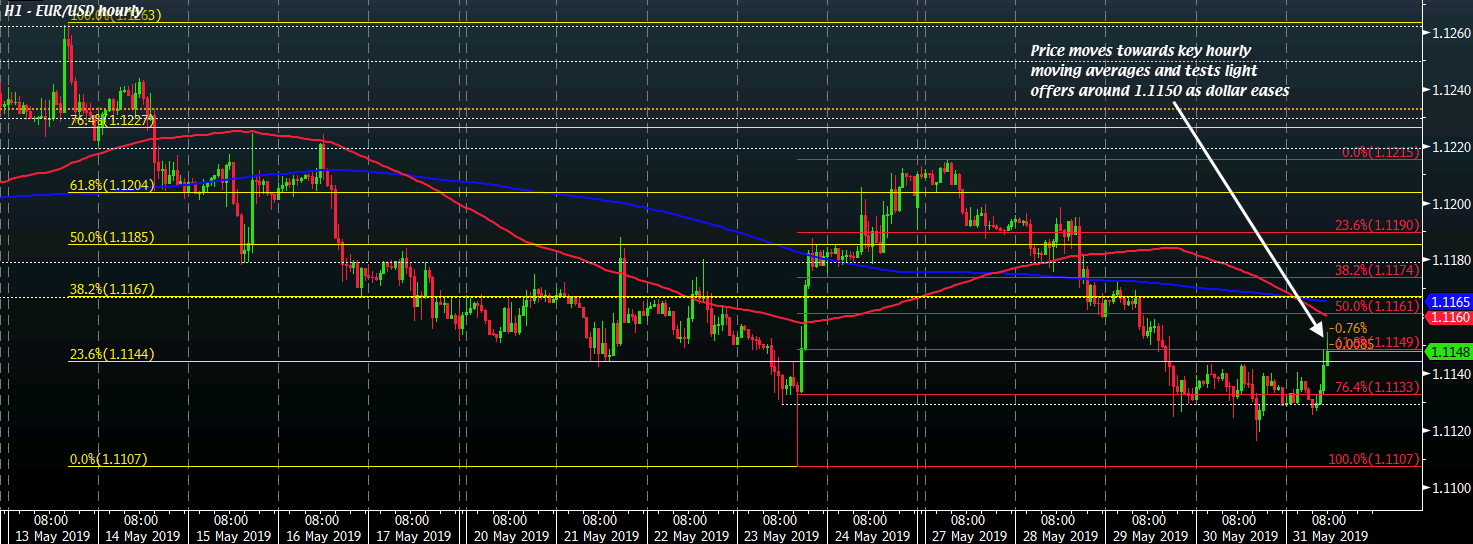

It’s tough to argue with the bond market. There’s no doubt now that fixed income is anticipating rate cuts as Trump fights a trade war on two fronts. That’s sent USD/JPY to the lowest since late January today and yields 8 bps lower at the front end.

Barclays now sees the Fed cutting rates three times — a total of 75 basis points — before year end. That mirrors a separate note from JPMorgan today where they forecast two cuts if the trade war with Mexico escalates.

“Last night’s tariff announcement adds yet another trade-related headwind to the growth outlook. If the Administration follows through on the proposed actions, we believe the adverse growth implications would prompt Fed easing.Even if a deal is quickly reached with Mexico, which seems plausible, the damage to business confidence could be lasting, with consequences that might still require a Fed response,” economist Michael Feroli wrote.

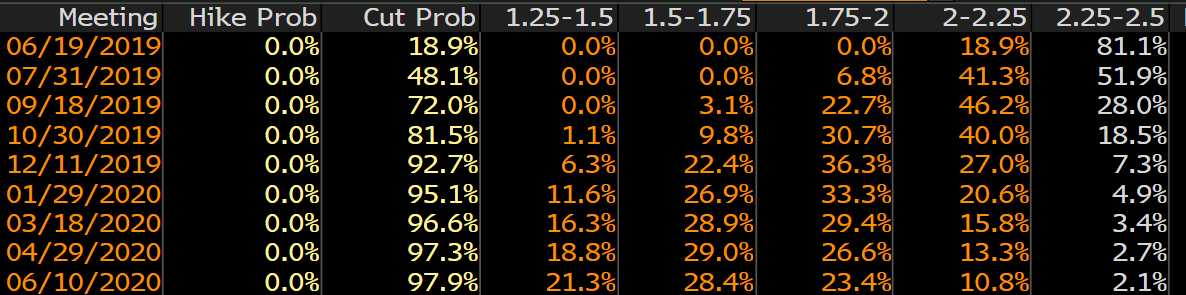

The Fed funds market is now seeing a 41% chance of a cut in July and a 73% chance of two cuts before year end.