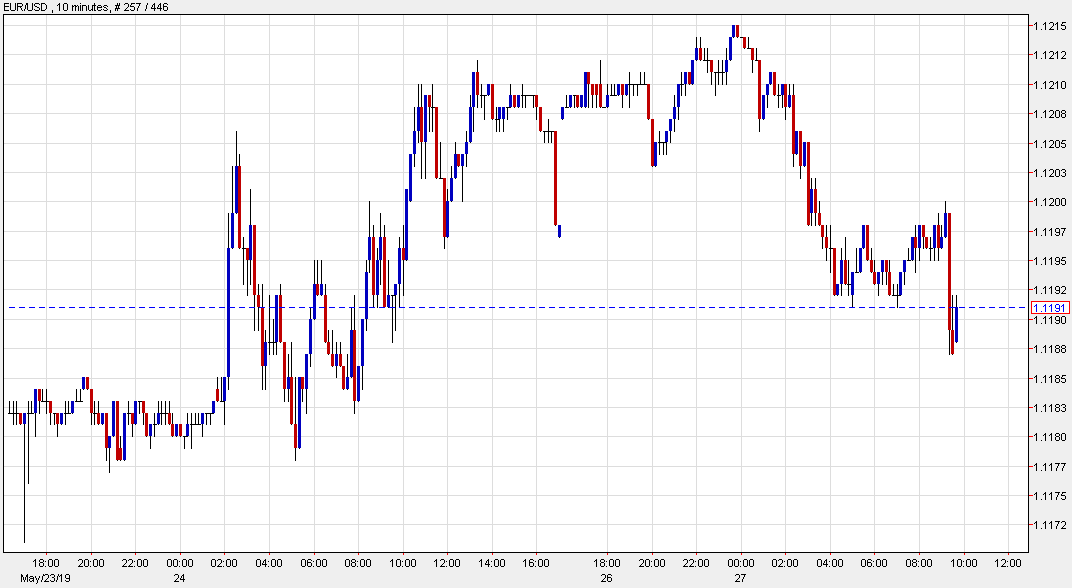

Euro edges lower

If you’re wondering what the latest dip down in the euro is about, it’s because the EU is considering starting disciplinary procedures against Italy for its failure to meet budget rules, according to a Bloomberg report.

This goes back to the extended battle over the budget in 2018 and the inability of Italy to grow its way out of high spending.

The report cites unnamed officials and says the next steps could come on June 5 and start a process that could lead to a 3.5 billion euro fine. That would be an unprecedented move and would need to be approved by EU finance ministers after a months-long process.

In short, it’s not going to happen but the process could inflame tensions and stoke more populism in Italy.

What’s especially notable is that this moves comes after a resounding win for Salvini in EU elections. With that, coalition partner 5-Star has said it will support his push for tax cuts — something that could further undermine the budget.