Samsung Electronics on Friday delivered an earnings shock for the first quarter with its quarterly operating profit falling 60 per cent, hit by lower prices of memory chips and display panels.

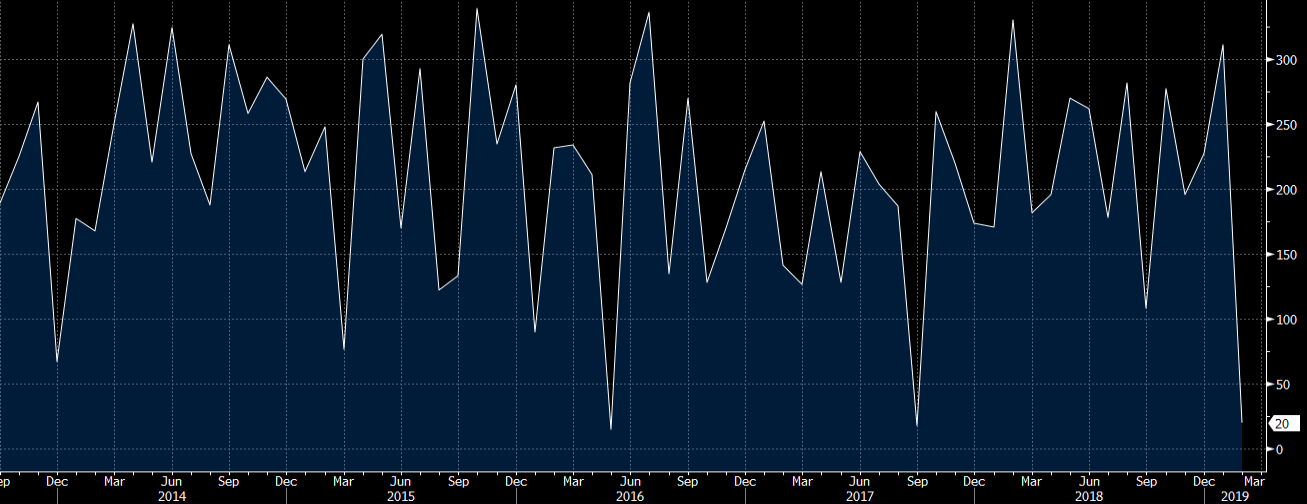

Operating profit at the South Korean technology giant was estimated at Won6.2tn ($5.5bn) for the first three months of this year, compared with Won15.64tn from a year earlier. Sales fell 14 per cent to Won52tn.

The company’s projection was far below analyst estimates although Samsung issued a profit warning last week in a rare regulatory disclosure that blamed slow demand for memory chips and an expansion of panel capacity among Chinese competitors.

The downbeat guidance is the latest sign of woes hitting global electronics makers as chipmakers have been hit by slowing demand and rising stock inventories following a slump in smartphone sales and a sharp fall in demand from cryptocurrency mining. The effects of a broader economic slowdown and worries over the US-China trade dispute have also been felt by the industry.

Analysts expect Samsung’s earnings to improve in the second half on seasonal demand and lower inventories. Such optimism has driven up the company’s shares by more than 20 per cent since hitting a two-year low in early January.