- Jesse Livermore is known for both colossal gains and losses. He made $million in 1929, and by 1934 he had lost all of it (an example that confirms the huge risk involved in stock trading).

- George Soros is one of history’s most successful stock and forex traders. He gained the nickname “the man who broke the bank of England” when he made $1 billion profit from selling $10 billion worth of pounds. He is the chairman of Soros Fund Management.

- Richard Dennis is a successful commodity trader based in Chicago. He made an estimated $200 million over a period of ten years from market speculating.

- Paul Tudor Jones became famous after the market crash of 1987 to make a whopping $100 million from shorting stocks. He is the founder of Tudor Investment Corporation.

- William Delbert Gann is known for developing technical indicators like Gann Angles and the Square of 9. He was a trader who used market forecasting techniques based on astrology, geometry, and mathematics.

- Bill Lipschutz turned $12000 investment in the stock market to $25000 in a few months but lost all of it. He then moved to forex trading, where he has made over $300 million.

- John R. Taylor Jr started as a political analyst for a chemical bank before becoming their forex analyst. He is the owner of FX Concepts, which is a currency managing firm.

- Stanley Druckenmiller is a successful trader who started as an oil analyst for the Pittsburgh National Bank. He was a part of a deal while working at George Soros that raked in $1 billion.

- Andrew Krieger is one of the best trader in the world. He sold kiwi, a New Zealand currency, a trade valued more than the total currency supply. He got revenue of $300 million from the trade.

- Michael Marcus is one of the best and most successful forex traders in the world. Legend Ed Seykota trained him. During the presidency of Ronald Reagan, Marcus held positions of almost $300 million in German marks.

Archives of “Trader (finance)” tag

rssEurostoxx futures +0.7% in early European trading

Some catch up play for Europe going into the open

- German DAX futures +1.1%

- UK FTSE futures +0.6%

- Spanish IBEX futures +0.6%

After the more upbeat mood in US equities yesterday, European indices have some catching up to do following the Easter break since last Friday.

The early gains belie the more measured risk mood so far today though, with US futures pulling back slightly after yesterday’s stellar advance. S&P 500 futures and Dow futures are down 0.2% while Nasdaq futures are keeping flatter with Treasury yields a touch lower.

That is keeping the dollar steadier and major currencies little changed so far on the day.

Eurostoxx futures +0.7% in early European trading

Optimistic tones observed in early trades

- German DAX futures +0.9%

- UK FTSE futures +0.9%

- Spanish IBEX futures +0.6%

European indices ended yesterday more mixed in another somewhat disappointing session, but the late gains seen in US stocks is giving risk buyers another shot in trading today.

This sets up a firmer open for equities later but that isn’t quite translating into much for the major currencies space as the focus remains on the dollar, as it meets some key technical crossroads going into the session ahead.

EuropeFX: Everything you need to know about CFDs trading

What you need to know about trading CFDs

Contracts-for-difference (CFDs) are popular trading instruments that provide investors with unique potential opportunities to profit in specific markets. This includes taking advantage of certain assets price movement, without actually owning the asset itself.

Thousands of CFDs exist, which are now a common fixture amongst brokerages’ offerings. CFDs are quite simplistic, as profit is calculated as the difference between the entry point of the trade and its exit point.

Popular types of CFDs

European shares end the session with declines

UK FTSE outperforms

The European shares are ending the session with declines. The UK FTSE 100 the better than others on the GBPs weakness.

The provisional closes are showing:

- German DAX, -1.06%

- France’s CAC, -1.25%

- UK’s FTSE 100, -0.10%

- Spain’s Ibex, -1.02%

- Italy’s FTSE MIB, -0.7%

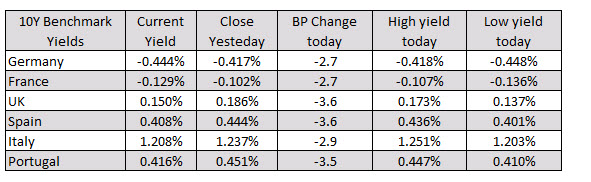

In the European debt debt market, the benchmark 10 year yields are ending lower across the board. Declines range from -2.7 basis points to -3.6 basis points:

In other markets as European traders look to exit:

- spot gold is trading up $6.05 or 0.34% at $1808.82. The low extended to $1790.79. The high for the day is near current levels at $1809.74

- WTI crude oil futures are trading up $0.31 or 0.77% at $40.41 for the August contract. The September contract is also higher by $0.33 or 0.82% at $40.65

In the US stock market the Dow industrial average outperforms while the NASDAQ index get whipped around and volatile trading. The current snapshot shows

- S&P index up 12.8 points or 0.41% at 3168.16

- NASDAQ index down 2.6 points or -0.02% at 10391.16

- Dow industrial average up 288 points or 1.11% at 26374

The NASDAQ index has whipped around in with the low falling -2.01%. The high extended up 0.42%. The point range is around 250 points from low to high.