- Find a voice recorder and record your stream of consciousness through the sequence of two to three trades or decisions.

- Do this in sequence

- Write down five to ten memories from before you were 18 years old.

- From that list, pick three that stand out from the rest. Maybe they still have an emotional charge, maybe you even think of them every once in a while.

- For these three memories, write the story of what happened, in the form of a kind of news report on who, what, where, why, and when.

- Take these stories and look at them from a different point of view. Ask what the other people in the story were feeling or what it seemed like they were feeling.

- Last, write down how the situation made you feel in the moment and what you told yourself about the situation.

- Then set the writing and the recordings aside for a few days or weeks. Just let both simmer in the back of your mind.

- Keep a bedside notebook and jot down your thoughts and feelings from your dreams right away. What matters is the sequence of feelings and emotions in the dream; or, in other words, those feelings that you wake up with in reaction to the events in the dream.

- Now summarize the following using the data of your memories

- What do I expect for myself?

- How do I expect things to turn out?

- How do I seem to feel about myself?

- What kind of labels do I talk about myself with?

- What fears come up?

- How do I react to others?

- How do I react to being told something other than what I want to hear?

- Go back to your trading recordings and summarize what feelings came up during your decision-making moments. We are looking for the themes and feelings that repeat themselves across market and decision sequences. Compare his information with what you discovered in the previous steps. What seems similar? If it doesn’t immediately click, let it rattle around in the back of your brain for a few weeks.

Archives of “Neuropsychology” tag

rssLessons from the spanish flu:

Learning from history

Here are a selection of interesting pieces I have come across in learning lessons from the ‘Spanish’ flu of 1918. Now the two pandemics are different. Our COVID19 pandemic primarily targets older people, while the Spanish flu hit those in the 20-30’s age bracket. The Spanish flu claimed over 45 million, but almost certainly never started in Spain!

What is the value of a single life (answer $10 million?) Check out this article for an interesting piece commenting on some research by Harvard University economist Robert Barro who argues that social distancing in 1918 did not work to reduce deaths because it did not last long enough. Barro argues that 12 weeks of social distancing works much better than 4-6 weeks.

What was the general approach taken during the Spanish flu of 1918? Check out this BBC article for a discussion of different approaches to the outbreak.

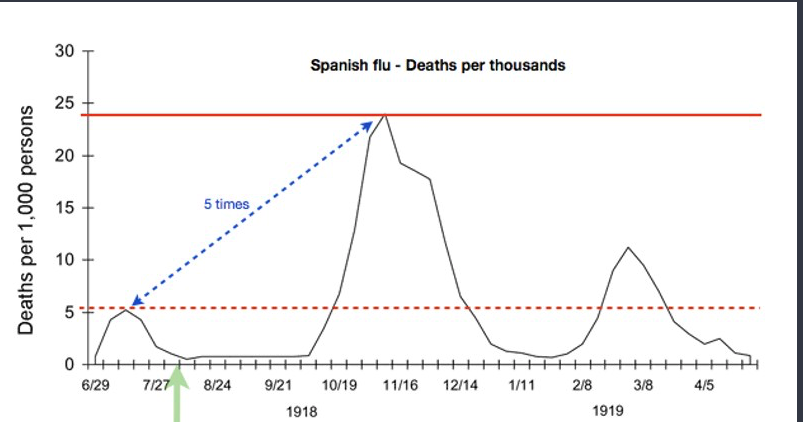

Pandemics come in waves – This National Geographic piece picks up the fact that pandemics tend to move in waves. A key takeaway is that we are unlikely to see a ‘one and done’ reaction. It is more likely to see a few waves of infections until we have a successful vaccine. Take a look at the Spanish flu waves seen in 1918/1919 in the chart below:

This an interesting Guardian piece: It seems that epidemics follow a similar pattern: They are ignored or dismissed until they are impossible to turn a blind eye too. That was very similar to the path of this pandemic.

One Liners for Traders

- “The paradox is realizing that being in control is about letting go.”

- “Even if you give your investments to others to manage, you are wholly responsible for that decision.”

- Letting go of your ego doesn’t create self-esteem. In order to trade soundly, you must lose your ego AND replace it with sound, prepared, professional judgment.

- The conscious mind assembles the data. The unconscious mind notices the patterns, makes the connections and guide your judgment.

- “The depth of your emotional resources is as important as your finances.”

- “The market is a collection of beliefs.”

- There is no content, only context.

- “If we ever fought battles, the main opponent was ourselves.”

- “If you persistently adopt someone else’s view, expect their performance. In that case, why don’t you just put the money into one of the thousands of funds and crystallize your implicit delegation of responsibility.”

3 Steps For Traders

So – are you ready?

Are you ready to unlock the greatness that you have within you to succeed as a trader?

Are you doubting that you have what it takes to succeed in the world of trading?

Well, we all have the same ability to succeed, you just have to know how to tap into it. Firstly, you need to understand a little about how you have ended up in the situation you are in now.

….. and let’s assume you are not where you really want to be, right?

Let’s get right to the point and identify what 3 things are influencing EVERYTHING in your life and giving you the results you currently have. (more…)