Massive week for European stock markets

- German DAX +3.4%

- UK FTSE 100 +2.2%

- Italy MIB +2.7%

- French CAC +3.5%

- Spain IBEX +4.2%

- German DAX +9.1%

- UK FTSE 100 +6.6%

- Italy MIB +10.9%

- French CAC +10.4%

- Spain IBEX +10.9%

Looking at the daily chart for the German DAX, the index moved above its 100 day moving average for the 1st time since February 24 this week. That moving average currently comes in at 11559.22. The price is closing above that level trading today giving a more positive bias despite the declines on the day.. The low today in the German DAX reached 11575.74 – above that key moving average level.

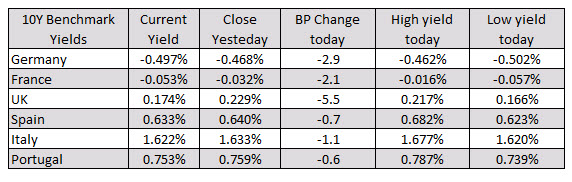

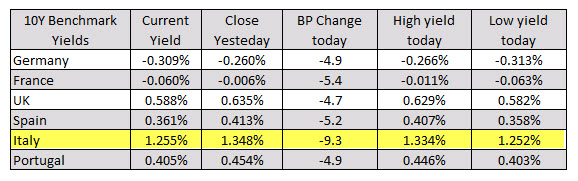

In the European debt markets, yields are ending sharply lower with Italy leading the way after regional elections turned back attempts from Salvini’s attempt to bring national politics more to the right (and away from the EU). Investors flocked into the Italian debt instruments.

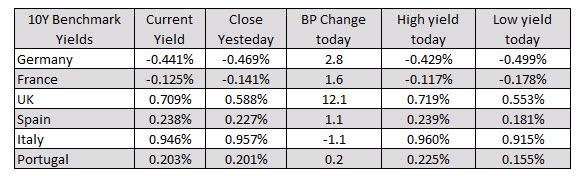

In the European debt market, the benchmark 10 year yields are mostly higher with UK yields soaring by 12.1 basis points on hopes for a Brexit deal.