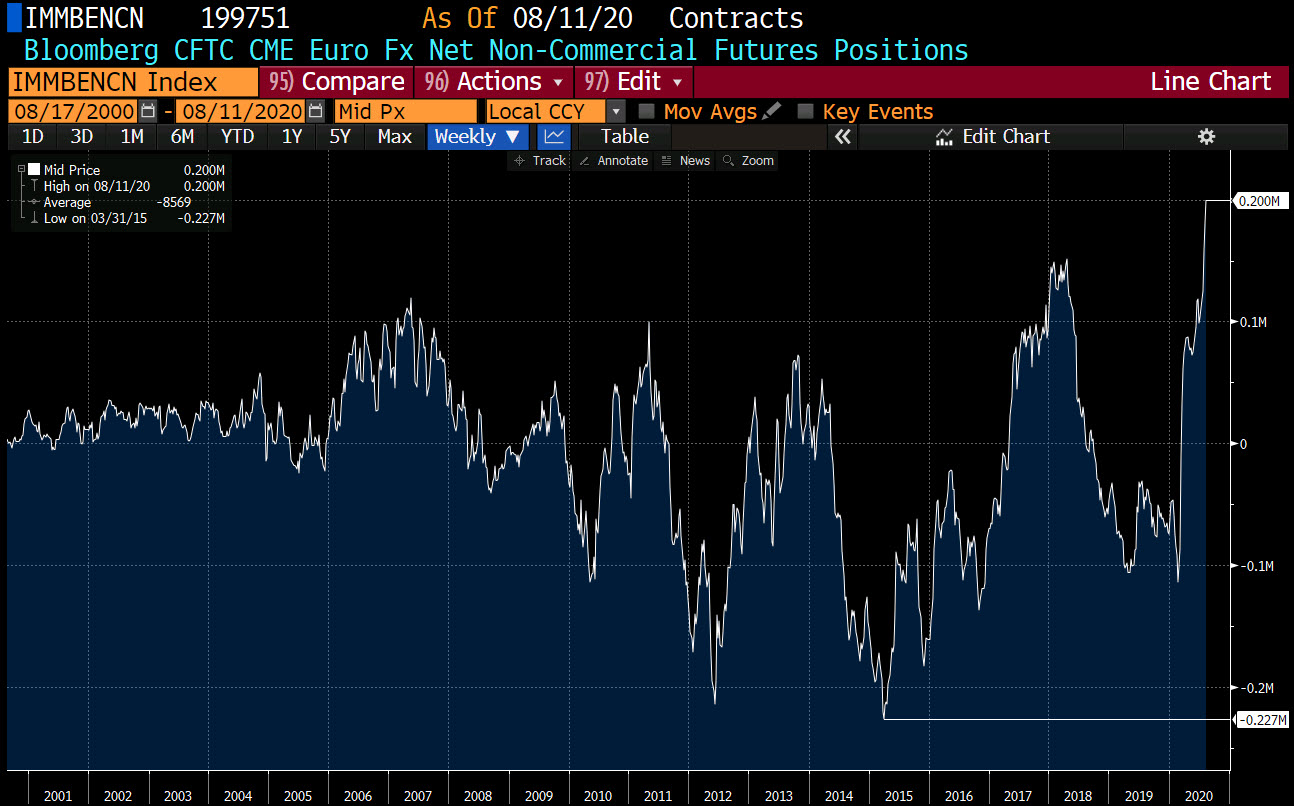

Weekly FX speculative positioning data from the CFTC

- EUR long 200K vs 180K long last week. Longs increased by 20K

- GBP short 3K vs 15K short last week. Shorts trimmed by 12K

- JPY long 27K vs 31K long last week. Longs trimmed by 4K

- CHF long 17K vs 12K long last week. Longs increase by 5K

- AUD short 1K vs 1K short last week. Shorts trimmed by 4K

- NZD 0K vs 1K short last week. Shorts trimmed by 1K

- CAD short 30k vs 23K short last week. Shorts increased by 6K

Highlights:

- EUR longs continue to rise and are at new record long position at 200K. The largest short position all time is at -227K

- GBP position has been whittled down to near unchanged after being short by 36K at the beginning of June 2020

- AUD and NZD speculative positions are near unchanged

- CAD shorts are the more or less, the only short currency position (long USD position).

For position trades, you may not want to be too involved in the intraday timing for your entry. Nonetheless, rather than just buying at a random time, e.g. at the open or at the close, your entry price can be improved by taking note of the intraday trend using some quick-and-dirty methods.

For position trades, you may not want to be too involved in the intraday timing for your entry. Nonetheless, rather than just buying at a random time, e.g. at the open or at the close, your entry price can be improved by taking note of the intraday trend using some quick-and-dirty methods.