DOE crude oil inventories for the week of July 10, 2020

- crude oil inventories -7.493 million vs. -2.1 million estimate

- gasoline inventories -3.147 million vs. -1.3 million estimate

- distillates inventories -0.453 million vs. 1.5 million estimate

- Cushing OK crude inventories 0.949 million vs. 2 point to 0 6 million last week

- US refinery utilization 0.6% vs. 0.5% estimate

- crude oil implied demand 17637 vs. 17586 last week

- gasoline implied demand 9248.4 vs. 9290.0 last week

- distillates implied demand 5023.7 vs. 4380.1 last week

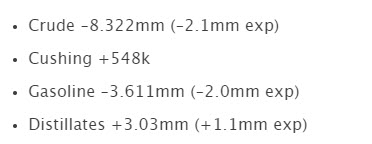

The private API data released near the close of yesterday’s trade showed a bigger than expected drawdown of -8.322. Today’s crude oil inventory data was below the API data by about 900 K. Below are the private data results:

Crude oil is trading at $40.50 just prior to the report. The current price is trading at $40.64