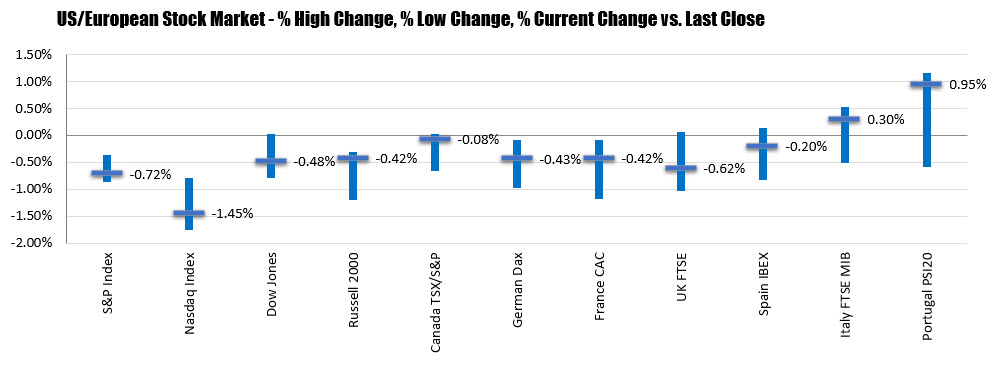

A good week for European equities as they benefit from flow of funds

- German DAX, -0.5%

- France’s CAC, +0.2%

- UK’s FTSE 100, +0.4%

- Spain’s Ibex, +0.45%

- Italy’s FTSE MIB, unchanged

- German Dax, +4.18%

- France’s CAC, +4.5%

- UK’s FTSE 100, +1.9%

- Spain’s Ibex, +4.1%

- Italy’s 4.9%

Year to date, all the indices are also higher:

- German Dax, +5.71%

- France’s CAC, +8.87%

- UK’s FTSE 100, +4.62%

- Spain’s Ibex, +6.9%

- Italy’s footsie MIB, +8.4%

In the forex, the snapshot of the strongest weakest as London/European traders look to exit shows the CAD is extending its lead to the upside after a trauma than expected jobs report today. The NZD and GBP remain the weakest. The USD is stronger but losing ground vs the CAD.

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit: