Imagine that users submitted hundreds of thousands of prices for everyday items, and that they all got compiled into a massive database. Then, suppose a worldwide index of prices was created that compared the cost of living across different places by using these many data points.

Well, that’s already happened at Numbeo which is the world’s largest database of user contributed data about cities and countries.

This infographic uses this information to show the most expensive and cheapest places to live by country. While it is missing some of the granularity of looking closer at individual regions and cities, it does do a good job of showing a broad perspective on living costs.

Switzerland and Norway may not surprise you as two of the most expensive countries. However, Venezuela might not have been a place that was on your radar. Of course, in retrospect, when you have inflation spiraling out of control at a rate of 64% per year, that will make things a bit pricey.

Want cheap goods and services? Head over to India, Nepal, and Pakistan. With about 1.5 billion people spread between those three countries, labour is cheap and the cost of living is very low. (more…)

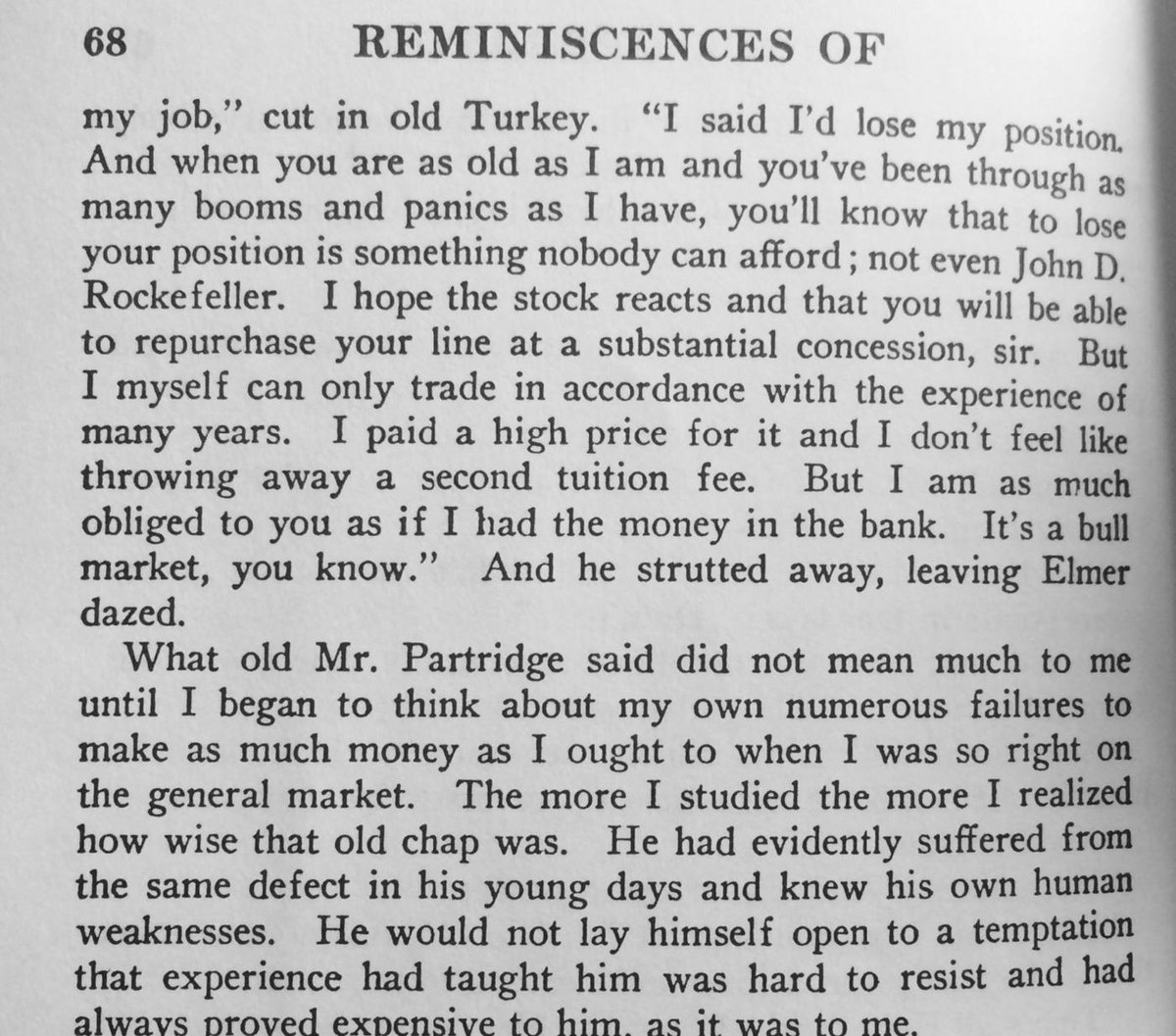

Fear, hope and greed are probably the three most common emotions traders deal with. Holding on to losers, exiting too early, or jumping in before confirmation are just a few examples of the things we do when emotion manages our trades for us. Trading without well-defined boundaries can be tempting, especially when things like intuition and “gut feeling” are things we take pride in as human beings.

Fear, hope and greed are probably the three most common emotions traders deal with. Holding on to losers, exiting too early, or jumping in before confirmation are just a few examples of the things we do when emotion manages our trades for us. Trading without well-defined boundaries can be tempting, especially when things like intuition and “gut feeling” are things we take pride in as human beings.