Global hope on Brexit and a US/China deal

The major European indices are ending the day (and the week) with solid gains. The provisional closes are showing:

- German DAX, up 2.7%. That is the best day cents January 4

- France’s CAC, up 1.7%

- UK’s FTSE, up 0.7%

- Spain’s Ibex, up 1.7%

- Italy’s FTSE MIB, up 1.8%

For the week, the major indices are also ending with decent games. Provisional changes for the week are showing:

- German DAX, +4.1%

- France’s CAC, +3.2%

- UK’s FTSE, +1.22%

- Spain’s Ibex, +3.28%

- Italy’s FTSE MIB, +3.1%

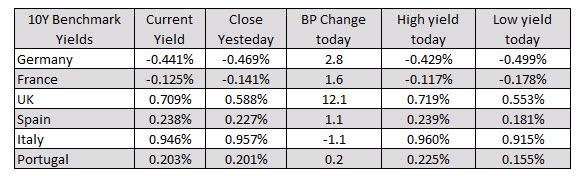

In the European debt market, the benchmark 10 year yields are mostly higher with UK yields soaring by 12.1 basis points on hopes for a Brexit deal.

Looking at the yield chart for the 10 year in the UK, the yield moved above its 100 day moving average today for the 1st time since little looks above in April and May (that failed). The last extended time above the 100 day MA was back in November 2018 (at much higher levels).