Japan GDP preliminary for Q2 2020, capturing the impact of the COVID-19 outbreak and response

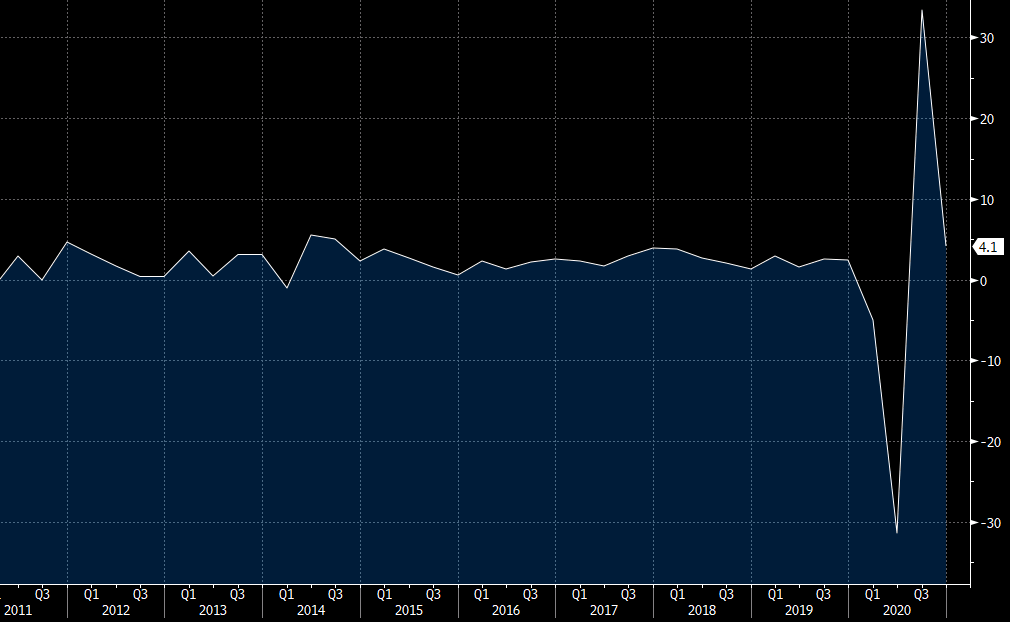

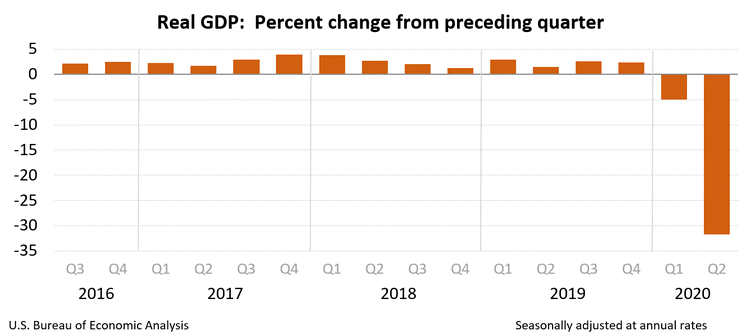

GDP sa -7.8% q/q , a miss on already ugly low expectations

- expected -7.5%, prior -0.6%

GDP annualised sa -27.8% q/q (ps when you see screaming headlines that Japan’s economy has shrunken 30% …. it hasn’t, but this is what the economically illiterate are referring to – you’ll know better)

- expected -26.9%, prior -2.2%

GDP nominal -7.4% q/q

- expected -6.5%, prior -0.5%

GDP deflator (an inflation indication) %

- expected 1.7%, prior 0.9%

Private consumption -8.2%

- expected -6.9% q/q, prior -0.8%

Business spending -1.5% … if there is some not quite so bad news to take away from the data release this smaller than expected drop in capex is it

- expected -4.0%, prior -1.7%

This is the 3rd consecutive quarter of GDP contraction for Japan.

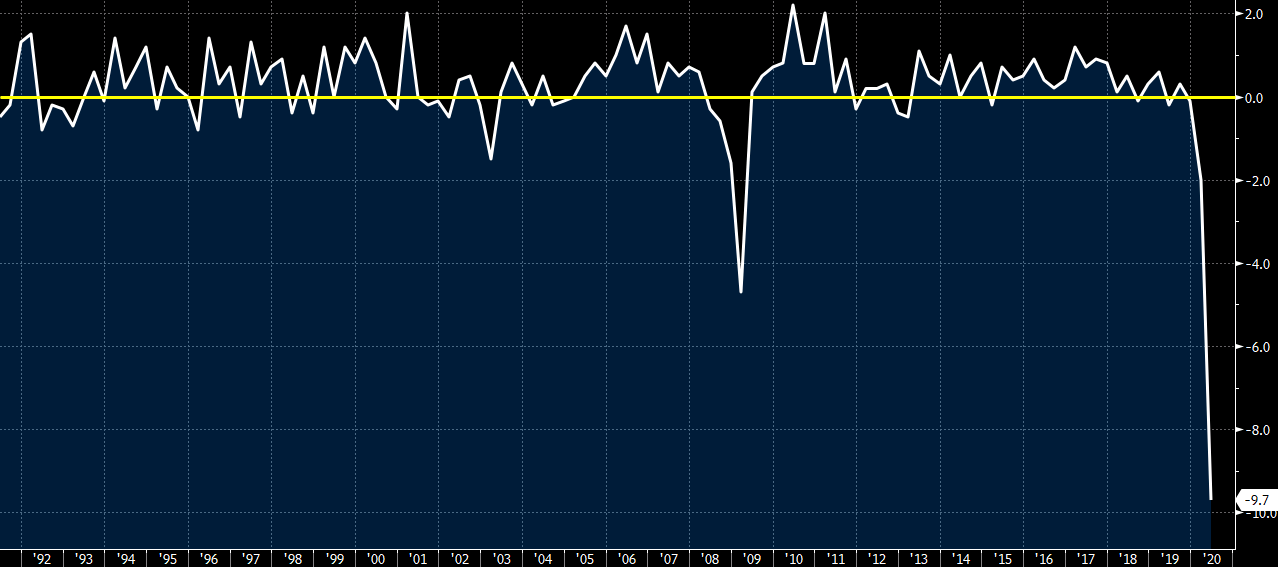

Japan is a net exporters, the decline in demand offshore has taken a heavy toll on shipments – Q2 exports fell at their fastest since Q1 2009 (GFC influence) and external demand has subtracted the biggest hit from GDP since 1980 (based on comparable data).

ps. yen is doing little on the data release.