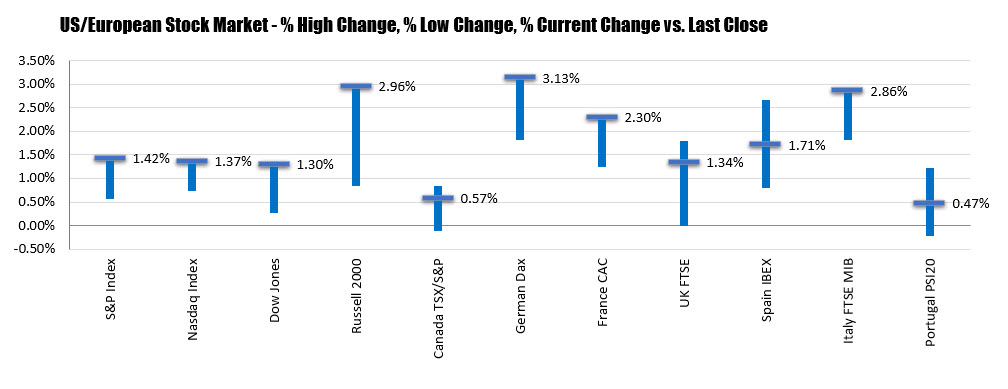

German DAX rises 1.5%. France’s CAC up 0.9%

The major European indices are closing higher and in the process reversed earlier session lows. Provisional closes are showing:

- German DAX, +1.5%. The low extended to -0.87%

- France’s CAC +0.9%. The low extended to -1.39%

- UK’s FTSE, +1.2%. The low extended to -0.68%

- Spain’s Ibex, +1.2%. The low extended to -1.66%

- Italy’s FTSE MIB, +1.1%. The low extended to -2.11%

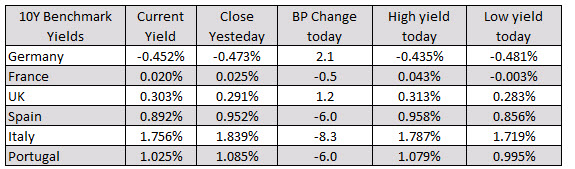

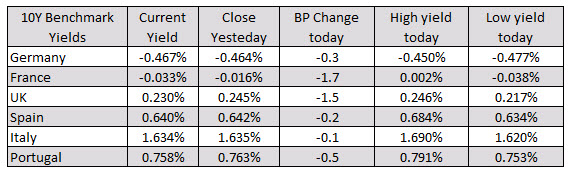

In the European debt market, the benchmark 10 year yields are ending the session lower. The biggest decline are was France at -1.7%. It moved above the 0.0% level at the highs today (high yield reached 0.002%). Buyers came in and pushed yield down into the close (trading at -0.033%).

In the UK today, the treasurysold £3.8bn of three-year gilts at a yield of -0.003%. That was the first sale below 0% in the UK as investors look for further declines in UK rates as the battle Brexit and coronavirus headwinds.

Bank of England’s governor Bailey said that the challenge for the central bank is getting inflation to return to target.

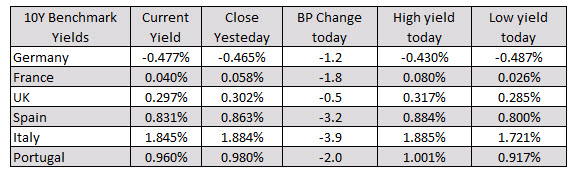

In the European debt market, the the benchmark 10 year yields were mixed with Germany and UK yields up while France, Spain, Italy, and Portugal yields lower.

In the European debt market, the the benchmark 10 year yields were mixed with Germany and UK yields up while France, Spain, Italy, and Portugal yields lower.