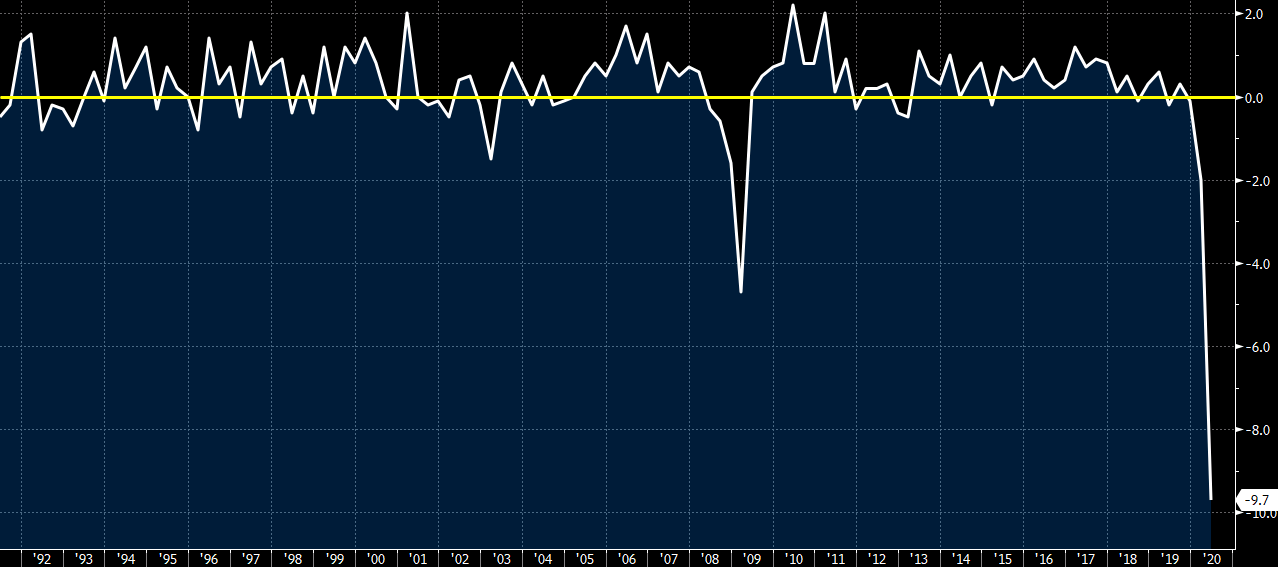

Latest data released by Destatis – 25 August 2020

- Non-seasonally adjusted GDP -11.3% vs -11.7% y/y prelim

- Working day adjusted GDP -11.3% vs -11.7% y/y prelim

- Private consumption -10.9% vs -9.8% q/q expected

- Prior -3.2%; revised to -2.5%

- Government spending +1.5% vs +1.5% q/q expected

- Prior +0.2%; revised to +0.6%

- Capital investment -7.9% vs -12.2% q/q expected

- Prior -0.2%; revised to -0.5%

Slight delay in the release by the source. The preliminary report can be found here.

The German economy shrank by slightly less than initially estimated, but it still is the biggest quarterly contraction on record amid the fallout from lockdown measures and the virus outbreak in general from April to June.

There was a heavy drag on consumption/spending but that is largely unsurprising and that contributed to the sharp decline in economic activity seen last quarter.