NASDAQ pushes higher and erases declines.

The major indices are closing higher on the day with the Dow industrial average leading the way today with a 0.62% gain. IT is the 3rd day in a row that the Dow has moved higher.

The S&P is on a 4 day winning streak. It closed up 0.58%.

The final numbers for the day are showing:

- S&P index up 18.76 points or 0.58% at 3276.06

- NASDAQ index up 25.765 points or 0.24% at 10706.12

- Dpw up 165.33 points or 0.62% at 27005.73

Microsoft has reported better top line and bottom line numbers after the close. The revenues came in at $38.0 billion vs. estimate of $36.54 billion

The earnings-per-share came in at $1.46 vs. estimate of $1.37.

Microsoft shares are trading down 2.19% in early after close trading at $206.65. Shares closed at $211.75.

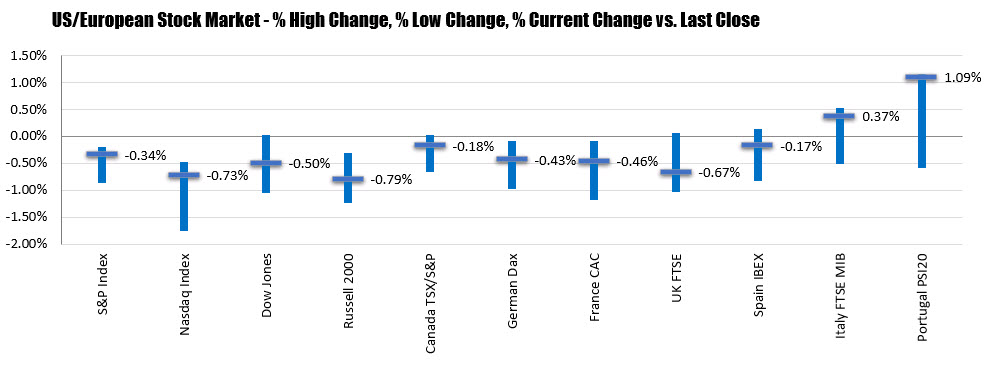

The US stocks are ending the day just off the lows for the day. The NASDAQ index by the way with a -1.27% decline.

The US stocks are ending the day just off the lows for the day. The NASDAQ index by the way with a -1.27% decline.

The buyers return to Amazon, Microsoft, Tesla ahead of their earnings over the next 2 weeks

The buyers return to Amazon, Microsoft, Tesla ahead of their earnings over the next 2 weeks Dow industrial average down for the 2nd consecutive day

Dow industrial average down for the 2nd consecutive day

After the close Netflix showed a greater than expected rise in new subscribers (10.1 million vs. 8.2M estimate),. But forecast Q3 subscribers much less than expectations at 2.5 million vs. 5.1 million estimate

After the close Netflix showed a greater than expected rise in new subscribers (10.1 million vs. 8.2M estimate),. But forecast Q3 subscribers much less than expectations at 2.5 million vs. 5.1 million estimate