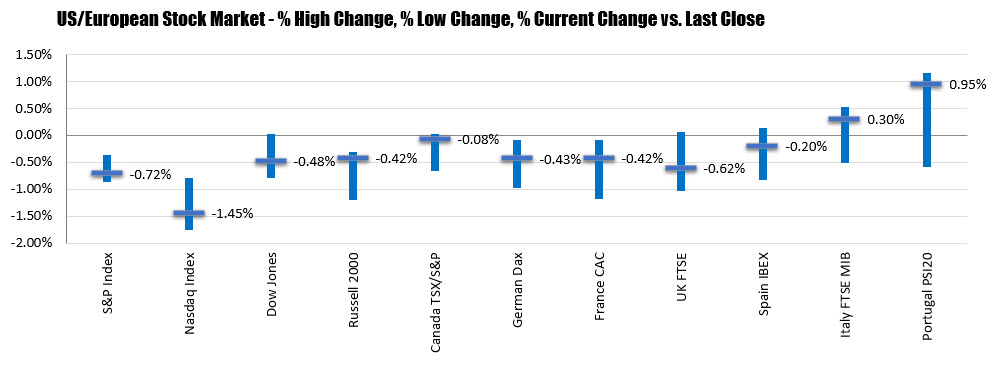

Indices close near lows for the day

- German DAX, -0.5%

- France’s CAC, -1.4%

- UK’s FTSE 100, -1.1%

- Spain’s Ibex, -1.7%

- Italy’s FTSE MIB, -0.7%

- German DAX -4.0%

- France’s CAC -3.49%

- UK’s FTSE 100, -3.25%

- Spain’s Ibex, -5.7%

- Italy’s FTSE MIB, -4.9%

- German DAX, unchanged

- France’s CAC, -3.1%

- UK’s FTSE 100, -4%

- Spain’s Ibex, -4.9%

- Italy’s FTSE MIB, -1.46%

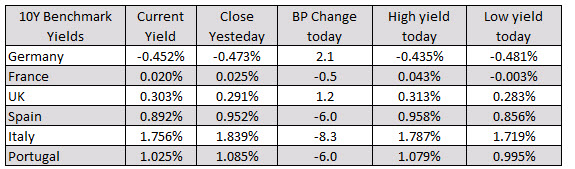

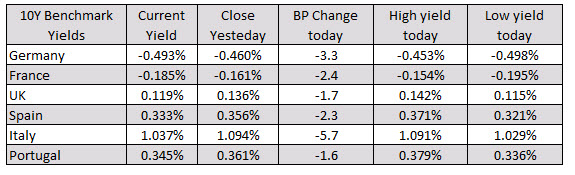

In the benchmark 10 year yields today, yields have moved back higher after being negative at the start of the North American session

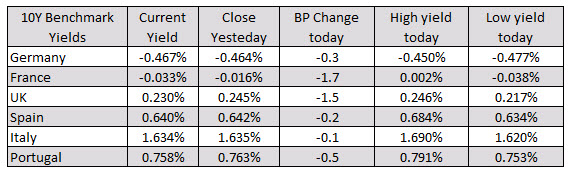

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit:

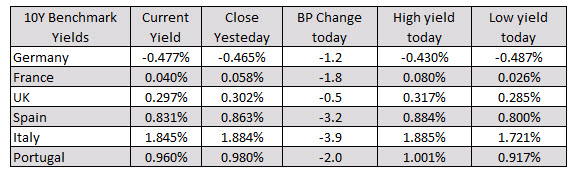

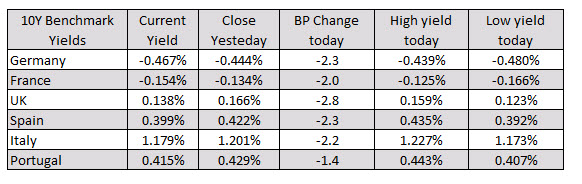

In the European debt market, the the benchmark 10 year yields were mixed with Germany and UK yields up while France, Spain, Italy, and Portugal yields lower.

In the European debt market, the the benchmark 10 year yields were mixed with Germany and UK yields up while France, Spain, Italy, and Portugal yields lower.