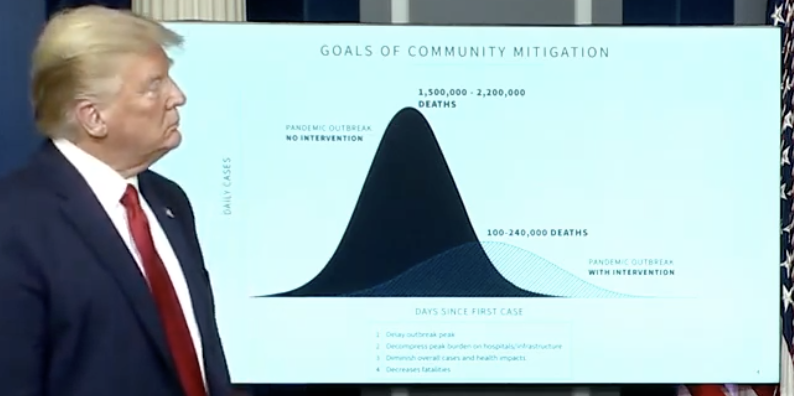

Fears of wave after wave (is the US even out of the first wave?) of COVID-19 in the US continue as cases, hospitalisation and deaths mount.

While case counts can be (and are) rationalised away citing increased testing, hospitalisation and the death toll cannot be swept under the carpet in the same way.

Via Reuters:

- Arkansas, North Carolina, Texas and Utah all had a record number of patients enter the hospital on Saturday

From the same report at Reuters:

- most states are not considering a second shutdown as they face budget shortfalls and double-digit unemployment. Many went ahead with reopenings before meeting government infection rate guidelines for doing so.

Health concerns are likely to keeping ‘risk’ in check.