CFTC positioning shows bets on the dollar have dropped

The Federal Reserves mid-cycle adjustment has chased out US dollar longs.

The week ahead will be an interesting one because the CFTC data is from Tuesday’s close. That was before Powell had the chance to commit to keep rates here or lower for a long time:

“I think we would need to see a really significant move up in inflation that’s persistent before we would even consider raising rates to address inflation concerns.”

The USD yield differential is still in place but it’s not as compelling as it once was, especially with the election now just a year away and all the related uncertainty.

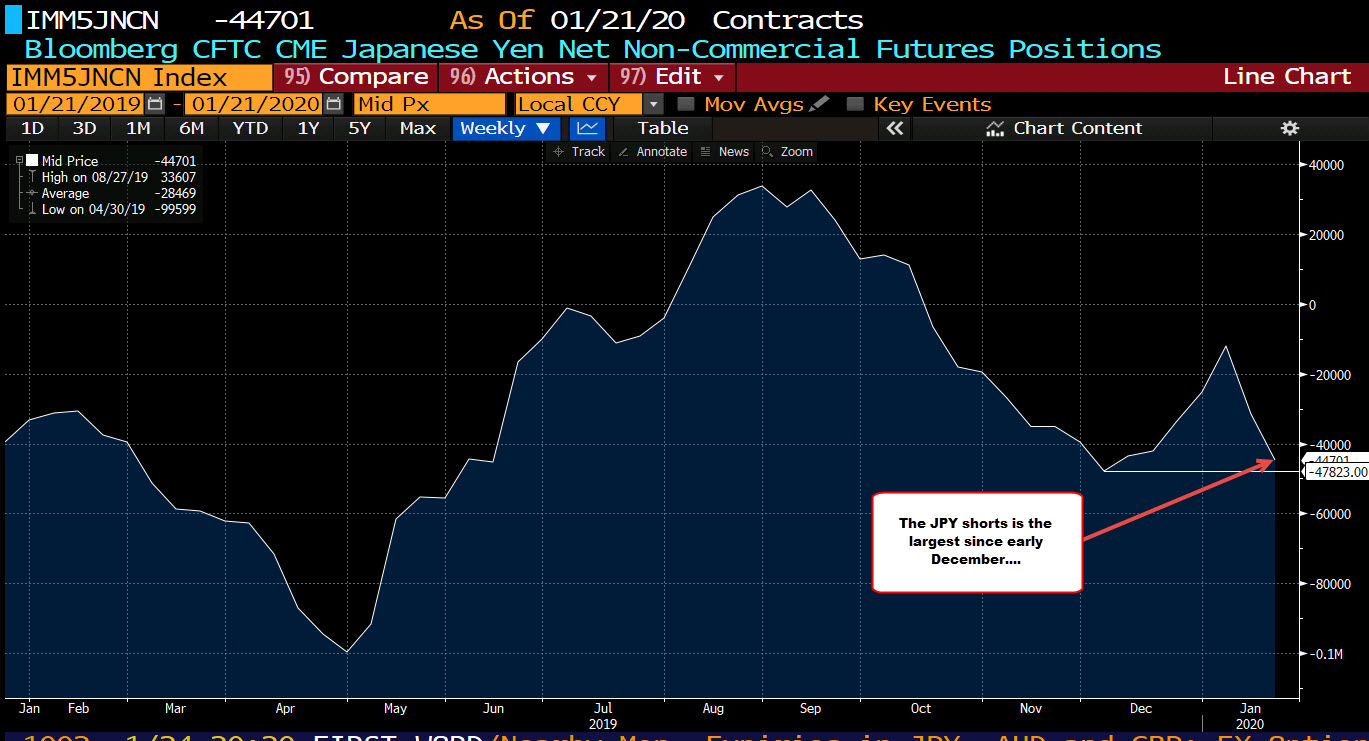

Here’s the chart showing the drop in net USD longs, from Bloomberg:

Is this really the end of the long-term dollar bull market? You would have to believe that better global growth is coming in 2020. But with the trade war on hiatus and a potential positive finish to Brexit, is that so unthinkable?