A look at the competitors in the oil price war

Disposition

So we have now an all-out oil price war between Saudi Arabia and Russia.

Russia is planning to increase its oil supplies undoing the December output cut once its term ends in March. It is assuring that its fund reserves are ready to absorb the damage from lower oil prices for as long as up to 10 years (with oil prices at $25-30 per barrel).

Saudi Arabia, in response, prepares to increase its own supplies for up to 12mln barrels per day. It also offers its crude under huge discounts, especially in Europe, to push away Russia from its core market.

The opposition doesn’t end here, however: the situation is actually a triangle of relationship rather than a Russia-Saudi Arabia standoff. The US is involved heavily, but indirectly, although it may be not that obvious: recently they just commented that they were hoping to see the oil market in an “orderly” condition.

Let’s observe the starting points of each protagonist here.

The US

Strengths

- ·The strongest world economy gives the US the highest strategic resilience to withstand any economic damage in the long-term.

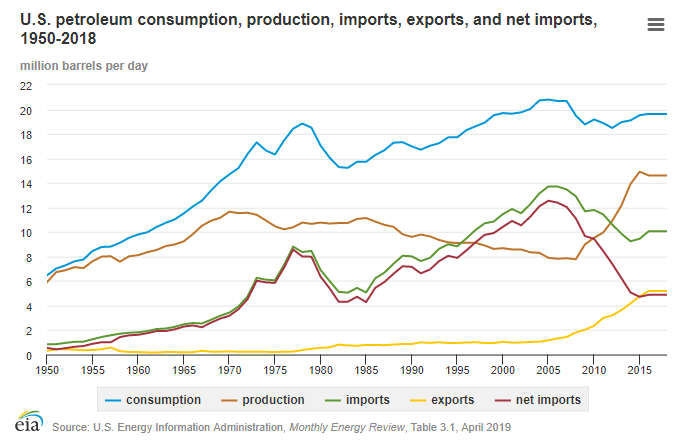

- ·The “newly-founded” domestic shale oil production satisfies a big part of domestic oil demand and enables oil exports.

Weaknesses

- ·The strongest world economy pushes the internal domestic oil demand chronically higher than the domestic oil production capacities and hence obliges the country to import oil from other countries.

- ·With the exception of just a few, the US shale oil producers’ break even price for a barrel of oil is well above the current price – that means, they are losing the game now and will most likely stay out as drilling new wells is not profitable.