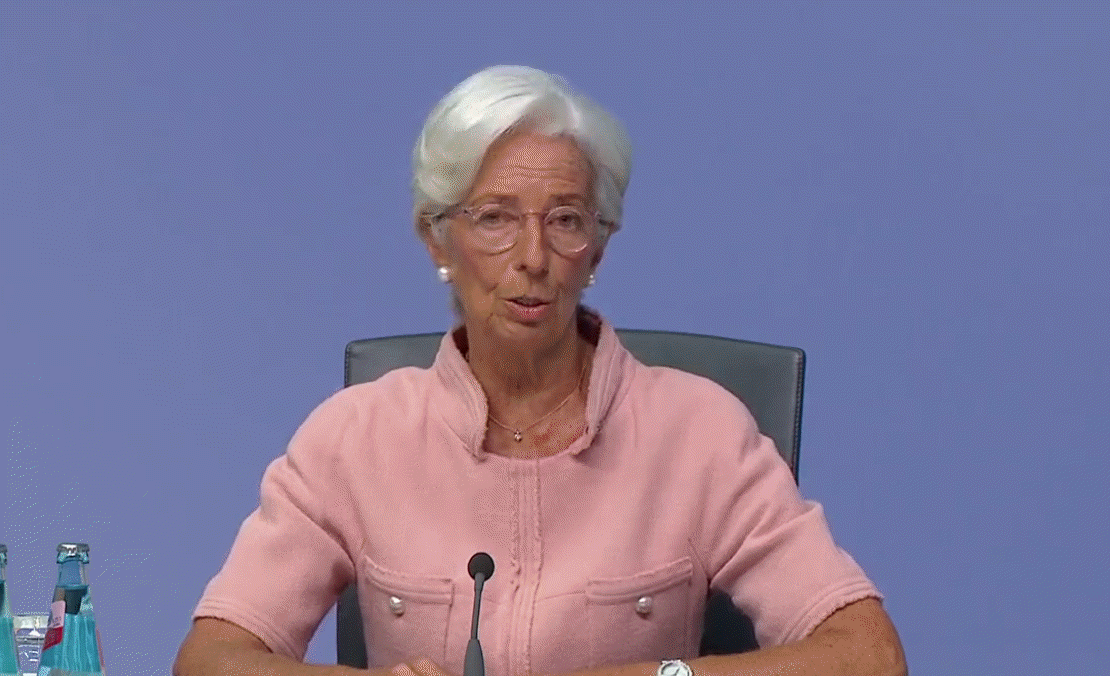

Comments from Lagarde in the ECB opening statement:

- Says ECB will monitor FX rate

- Strength of recovery remains surrounded by uncertainty

- Rebound broadly in line with previous expectations

- Domestic demand recorded significant recovery

- Uncertainty weighing on consumer spending and business investment

- Inflation dampened by energy prices

- Ample monetary stimulus remains necessary

- Incoming data suggest notable recovery in consumption

- ECB will carefully assess the euro’s effect on inflation

- New infections are a headwind to the short term outlook

- Repeats that an ample degree of easing needed

- Fiscal measures should be targeted and temporary

The euro jumped to 1.1891 from 1.1850 on the headline from Lagarde.