France and Spain indices move lower

The European shares are ending the session with mixed results. France and Spain indices are lower. Germany, UK, Italy are trading higher.

The provisional closes are showing:

- Germany Dax, +0.44%

- France CAC, -0.36%

- UK FTSE 100, +0.6%

- Spain’s Ibex, -0.34%

- Italy’s FTSE MIB, +0.2%

For the week, the indices closed higher:

- German DAX, +2.3%

- France’s CAC, +1.9%

- UK’s FTSE 100, +3.15%

- Spain’s Ibex, +1.8%

- Italy’s FTSE MIB, +3.1%

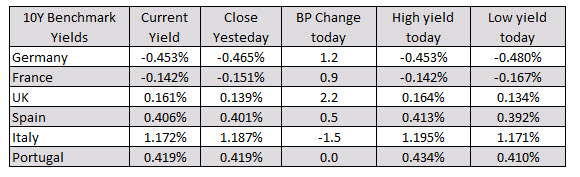

In the European debt market, the benchmark 10 year yields are mostly and modestly higher. The exception is the Italian 10 year which is trading down -1.5 basis points.

In other markets as European/London traders look toward the exits for the week:

- spot gold is trading at $13.50 or 0.75% $1810.70. The high price extended to $1811.11 the low has reached $1795.96

- WTI crude oil futures are trading down $0.27 or -0.66% of $40.48. The high for the August contract reached $40.90 while the low extended to $40.02. The September contract is currently trading down $0.27 or 0.66% at $40.66

In the US equity market, the major indices are trading mixed. The Dow industrial average is down on the day while the S&P and NASDAQ index are currently trading in the black

- S&P index is up 3.25 points or 0.10% at 3218.81

- NASDAQ index is up 11.5 points or 0.11% at 10,485.25

- Dow industrial average is trading down 43.12 points or -0.16% at 26691.40

In the US debt market the yields are trading near unchanged across the curve:

- 2 year 0.143, -0.2 basis points

- 5 year 0.278%, +0.3 basis points

- 10 year 0.618%, +0.1 basis point

- 30 year 1.314%, +0.6 basis points

A look at the strongest and weakest currencies at the close of the London session shows the CHF is the strongest and the GBP is the weakest. The US dollar is mostly lower.

Major indices close lower last week. The week is getting off to a better start

Major indices close lower last week. The week is getting off to a better start

Major indices close lower last week. The week is getting off to a better start

Major indices close lower last week. The week is getting off to a better start