Scanning across some notes on OPEC and crude, some snippets … not optimistic:

Via RBC:

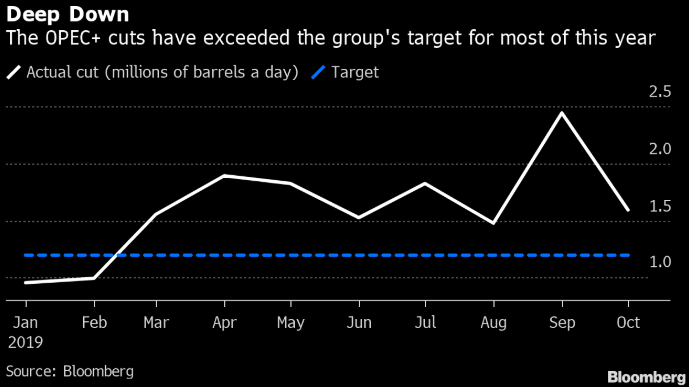

- OPEC+ is apparently in crisis management mode

- We think OPEC+ may make more headway by sharpening its compliance messaging, particularly around perennial underperformers, most notably Russia.

- we think Saudi Arabia may be amenable to dropping production even further

- none of these measures will arrest the immediate demand destruction and storage saturation problems that are weighing so heavily, particularly on US prices, they could potentially help ensure a better back half of the year if the COVID-19 crisis is contained

(Bolding above is mine)

Via TD:

- Although we don’t expect negative prices to remain … the imbalance in the offer vs. demand and storage capacity issues could see a repeat of this issue.