Via a note from Bank of America’s chief investment strategist, looking for US stocks to slide a little further.

And then rebound ahead of the US November election. The recent fall (still ongoing) is due to investors losing patience with the lack of further fiscal support from the US Congress.

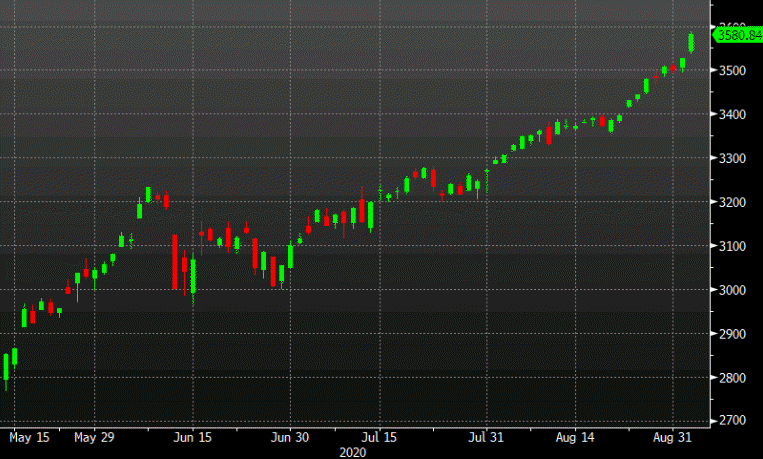

Targets the S&P 500 to 3,630 prior to November,

- Says to buy Nasdaq Composite at 11,000

On policy:

- Historic policy shift underway at Fed

Says Fed is willing to let financial assets overshoot to

- a. stoke employment & wages,

- b. finance fiscal excess

Further adds that the market knows Fed will ‘intervene’ to prevent <1% Treasury yield which has allowed SPX multiple to break 20x .

- & global central banks’ easing programs are “operation warp speed”

Ahead:

- key catalyst for a further market rally is more fiscal stimulus

- & a viable coronavirus vaccine