Archives of “US Market” category

rssUS stocks close lower. Dow and S&P close down 1%

Dow post 2 day losing streak

The US stocks are closing lower with the Dow and S&P each down about 1%

- all S&P sectors close lower

- NASDAQ closes down for the 3rd time in 4 days

- NASDAQ on pace for a decline for the week

- Dow post a 2 day losing streak

The final numbers are showing

- S&P index -35.67 points or -1.0% at 3536.99. The low price reached 3518.58. The high price extended to 3569.02

- NASDAQ index fell -76.84 points or -0.65% at 11709.59. The low price reached 11666.375. The high price extended to 11847.84

- Dow industrial average fell 318 points or -1.08% at 29080.13. The low price extended to 28902.13. The high price extended to 29311.83

The indices are lower on the back of concerns about Covid.

NASDAQ index rebounds 2% and closes near the highs

Dow industrial average closes lower for the 1st time this week

The NASDAQ index led the charge today the gain over 2%.

- As it closes near session highs

- NASDAQ snapped today slide

- Dow industrial average snaps 2-day rise

- NASDAQ closes higher for the 1st time in 3 days. The pair fell -1.53% on Monday, and -1.37% yesterday

- S&P closed higher for the 2nd time in 3 days

The final numbers are showing:

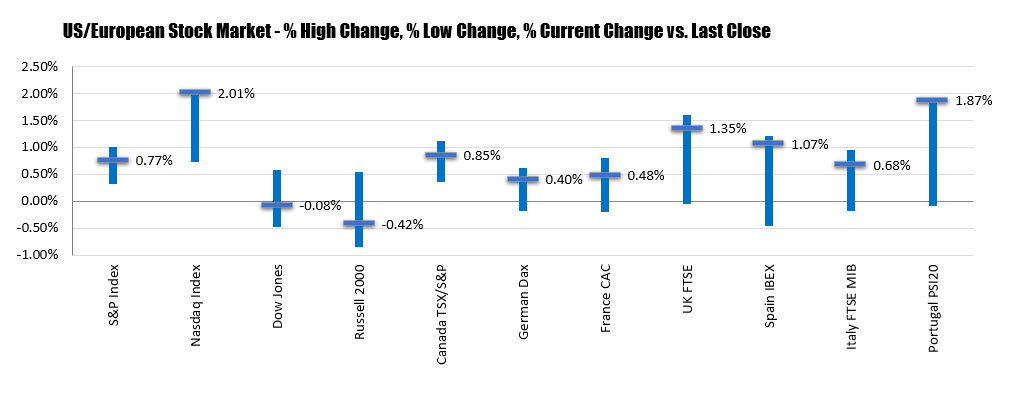

- S&P index +27.14 points or 0.77% at 3572.66

- NASDAQ index closed up 232.57 points or 2.01% at 11786.43

- Dow industrial average closed down 23.29 points or -0.08% at 29397.63.

In the European markets today, the major indices all close higher for the 3rd consecutive day. The gains were led by the Portuguese PSI 20 and the UK FTSE 100 (+1.35%).

Some big winners today included:

Some big winners today included:- Zoom +9.87%

- Chewy, +6.73%

- Square, +6.66%

- Crowdstrike, +6.06%

- Qualcomm, +5.47%

- Nvidia, +5.2%

- Papa John’s, +4.95%

- PayPal, +4.9%

- Chipotle, +4.86%

- Slack, +4.48%

- AMD, +4.22%

- Broadcom, +3.56%

Some losers today included him him:

- Delta Air Lines, -5.43%

- American Airlines -4.15%

- United Airlines -3.87%

- Southwest Airlines -3.53%

- Boeing -3.42%

- Emerson -3.28%

- Raytheon technologies, -3.0%

- Walt Disney, -3.0%

- American Airlines, -2.71%

- Stryker, -2.29%

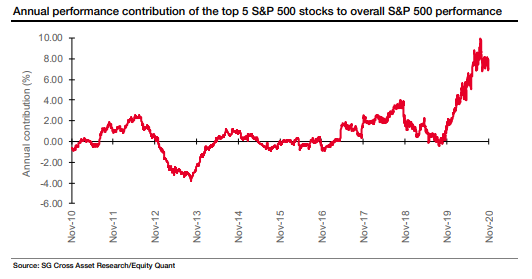

Contribution of the 5 largest companies to the annual profitability of the S&P 500.

The influence of compounding on the performance of the S&P 500.

Have US stocks topped for the year?

Via Bloomberg

I came across a Bloomberg piece making a case for vaccine euphorias being overdone. The heart of the thinking was as follows:

- Traders are not immunologists and have not driven down into the detail. Initial results show that protection is achieved 7 days after the second dose, which must come three weeks after the first dose. The whole process takes 28 days. So in order to be effectively vaccinated by year end you need to start the process by December 03.

- A 90% base effectiveness rate is a good sign for other vaccines which suggests there may be a range of other options in the first half of 2021

- The vaccine needs to be stored and transported at -70C which makes for logistical challenges. Pfizer hopes to apply to the FDA to start distributing later in November and has around 50 million doses prepared this year (enough to treat 25 million). This means that the best case scenario is for 25 million people vaccinated by year end.

- Now consider that 3.9 million people got the virus last week. So that means that if you assume this number of people get the virus each week it will mean that by year end there will be 29 million new cases, but only 25 million vaccinated. A net growth of 4 million cases.

All of the above points mean that the vaccine process will take time and that a correction lower in US stocks would make sense heading into year end.

Rotation out of NASDAQ into Dow for the 2nd consecutive day

S&P index falls marginally

For the 2nd consecutive day, there has been a rotation out of NASDAQ stocks into the Dow 30. The S&P is caught in between and little changed on the day.

- NASDAQ down for the 2nd straight day

- Dow closes near session highs

- S&P closes near unchanged

- Dow transports post record close

- Dow closes higher for the 6 time and 7 days

- Russell 2000 index rises by 1.88%

- S&P closes lower for the 2nd time in 3 days

The final numbers are showing:

- The S&P index fell -5.06 points or -0.14% at 3545.44

- The NASDAQ index fell -159.92 points or -1.37% at 11553.85

- The Dow industrial average rose 262.49 points or 0.9% at 29420.46

Big losers include:

- Beyond Meat, -16.92%

- Zoom, -9.01%

- Alibaba, -8.26%

- Square, -6.56%

- Slack, -6.55%

- Nvidia, -6.32%

- First Solar, -6.22%

- American Airlines, -6.21%

- AMD, -6.17%

- Intuit, -4.98%

- Salesforce, -4.47%

- Microsoft -3.35%

Big gainers today include:

- Walgreens, +6.42%

- Black Knight, +5.72%

- Boeing, +5.19%

- Chevron, +4.65%

- Northrup Grumman, +4.46%

- Raytheon, +4.43%

- 3M, +3.4%

- Charles Schwab, +3.27%

- Papa Johns, +3.22%

- General Dynamics, +2.76%

- Gilead, +2.64%

- Southwest airlines +2.19%

JP Morgan forecast S&P500 to 4000 in early 2021 and higher still after that

An ICYMI from a note from JPM (via Reuters)

- S&P 500 index to hit 4,000 by early 2021

- Pfizer COVID-19 vaccine update “one of the best backdrops for sustained gains in years.”

- index to hit about 4,500 by the end of 2021

NASDAQ tumbles into the close. Dow and S&P close higher but near session lows

Dows best day since June 5

The major indices opened sharply higher on the back of the Pfizer news on a vaccine. The gains were led by the Dow industrial average the S&P index. The NASDAQ index went along for the ride early on. However, a late day selling pushed the NASDAQ into negative territory. The Dow industrial average and S&P index also close near session lows but still higher on the day.

- All the major indices reached intraday all time record highs.

- Dow had his best day since June 5

- Covid gainers got hammered today including Zoom, Home Depot, Whirlpool, Amazon and Netflix

A look at the final numbers shows:

- S&P index rose 41.06 points or 1.17% at 3550.50. The high price reached 3645.99. The low price extended to 3547.48

- NASDAQ index fell -181.448 points or -1.53% at 11713.78. It’s high price reached 12108.06. The low price reached 11703.49

- Dow industrial average rose 834.57 points or 2.95% at 29157.97. It’s high price reached 29933.83. The low price extended to 29130.66.

Some losers today included:

- Zoom, -17.4%

- Crowdstrike, -10.76%

- Whirlpool, -10.4%

- snowflake, -9.49%

- Netflix, -8.56%

- Square, -7.09%

- Costco, -5.39%

- Amazon, -5.06%

- Facebook, -5.04%

- Home Depot, -5.03%

winners included:

- American Express, +21.43%

- United Airlines, +19.23%

- American Airlines, +15.18%

- Bank of America, +14.27%

- Boeing, +13.71%

- J.P. Morgan, +13.62%

- Walt Disney, +11.87%

- Citigroup, +11.64%

- PNC financial, +11.57%

- Exxon Mobil, +10.34%

- MasterCard, +9.93%

- Southwest Airlines, +9.72%

More on Pfizer’s covid-19 vaccine

Some of the details of the study from Pfizer and BioNTech

- Study enrolled 43,538 participants and had no safety concerns

- 94 participants contracted covid-19

- Vaccine candidate was found to be more than 90% effective

- Trial will continue until 164 confirmed cases

- News release

Albert Bourla, Pfizer Chairman and CEO, said this was the most important medical discovery in 100 years. I’m not going to be challenge that statement but given the market’s reaction, it’s certainly the most important medical news in a long time.

“Today is a great day for science and humanity. The first set of results from our Phase 3 COVID-19 vaccine trial provides the initial evidence of our vaccine’s ability to prevent COVID-19,” said Dr. Albert Bourla, Pfizer Chairman and CEO. “We are reaching this critical milestone in our vaccine development program at a time when the world needs it most with infection rates setting new records, hospitals nearing over-capacity and economies struggling to reopen. With today’s news, we are a significant step closer to providing people around the world with a much-needed breakthrough to help bring an end to this global health crisis. We look forward to sharing additional efficacy and safety data generated from thousands of participants in the coming weeks.”

The math of the study is simple: 94 cases in trial participants, about 9 of the vaccine recipients got covid-19, about 85 placebo recipients got it. That’s tough math to argue against.

Meanwhile, the vaccine news keeps on coming with Novavax saying its covid vaccine has gotten the FDA’s fast track designation.