Archives of “US Market” category

rssDuring this year, the ‘zombie’ companies are being more profitable than the S&P 500.

The world’s largest asset manager has upgraded US equities to “overweight”

BlackRock is the world’s largest asset manager, have turned bullish on quality large cap technology companies as well as small cap firms that tend to perform well during a cyclical upswing.

Reuters carry the report:

- BlackRock said it prefers the United States – has a higher share of “quality” companies with strong balance sheets and free cash flow generation in the high-flying tech and healthcare sectors

- resurgence in virus cases in Europe and the United States could led to further outperformance of large cap tech and healthcare companies

- BlackRock turned bearish on Europe.

Monthly SPX back to 2006 or so. Ok then.

US equities get a late lift to finish higher

Closing changes for the main markets:

- S&P 500 +0.6%

- DJIA +1.1%

- Nasdaq +0.2%

- Russell 2000 +2.0%

The rotation to value continues

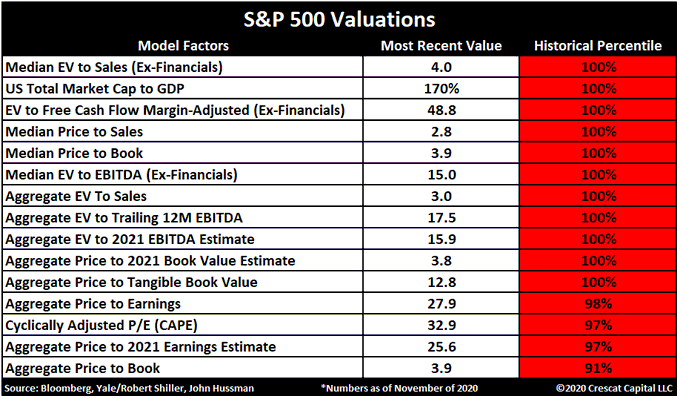

Since 2009, monetary expansion explains much of the revaluation of the North American indices.

Major indices close near session highs. Snap 2 day losing streak

NASDAQ index leads the way

The NASDAQ and S&P index are closing near session highs. In the process they are snapping a 2 day losing streak. The Dow industrial average also euros but at a more modest pace.

The final numbers for the day are showing:

- S&P index up 14.08 points or 0.39% at 3581.87

- NASDAQ index up 103.11 points or 0.87% at 11904.71

- Dow industrial average up at 44.81 points or 0.15% at 29483.23

Despite the gains, the S&P index is on track for a weekly loss.

Some leaders today include:

- Goodrx, +12.47%. The online pharmaceutical company was hit hard over the last few days on the news that Amazon would be entering that market

- Crowdstrike, +4.52%

- Wells Fargo, +4.43%

- Slack, +4.41%

- AMD, +3.7%

- Square, +3.39%

- Alcoa, +3.33%

- Salesforce, +2.93%

- Tesla, +2.54%

- First Solar, +2.5%

- Beyond Meat, +2.48%

Some losers today include:

- Exxon Mobil, -3.72%

- General Dynamics, -2.29%

- United health, -2.18%

- Booking.com, -1.69%

- Walt Disney, -1.52%

- Amgen, -1.36%

- Charles Schwab, -1.28%

- Chubb, -1.25%

- AT&T, -1.19%

- Walgreen boots, -0.99%

- FedEx, -0.99%

- MasterCard, -0.6%

- Gilead, -0.44%

Most shorted index nearing 2018 high as vaccine headlines result in parabolic blowoff

Russell 2000 closes at record for the 3rd consecutive day

Major indices all closed lower

The good and bad for the stock market day is that the small-cap Russell 2000 closed at record levels for the 3rd consecutive day. The not so great news is that the major indices all closed lower on the day and snapped today winning streaks.

- Dow on track for best month since January 1987

- Dow transports closed at record high

The final numbers are showing:

- S&P index fell -17.38 points or -0.4% to 3609.53. The high price reached 3623.11. The low price extended to 3588.68

- NASDAQ index fell -24.785 points or -0.21% to 11899.34. The high price reached 11950.18. The low price extended to 11852.41

- Dow industrial average fell -167.09 points or -0.56% to 29783.35. The high price reached 29872.42. The low price extended to 29520.29.

Some winners today included:

- Tesla, +8.19%. It was announced that it would be added to the S&P index

- Square, +4.82%

- Crowdstrike, +4.67%

- Charles Schwab, +4.29%

- Boeing, +3.79%

- Slack, +2.61%

- Snowflake, +2.53%

- Salesforce, +2.53%

- Box, +2.22%

- Pfizer, +1.85%

- FedEx, +1.83%

Losers today included:

- Goodrx, -22.54%. Amazon announced today that they would enter the prescription services business

- RiteAid, -16.29% (Amazon competition)

- Walgreen boots, -9.64% (Amazon competition)

- CVS -8.62% (Amazon competition)

- Boston Scientific, -7.86%

- Home Depot, -2.51%. The shares fell down despite beating on revenues and earnings today

- American Express -1.86%

- Stryker, -1.79%

- Cisco, -1.55%

- Intel, -1.41%

- Facebook, -1.39%. Mark Zuckerberg testified on Capitol Hill today

- Corning -1.32%

- Microsoft, -1.26%

US futures a little lower ahead of European morning trade

A bit of a fizzle once again after the early optimism to start the new week?

S&P 500 futures are down 0.4% with Dow futures seen down 0.3% ahead of European trading today, with Nasdaq futures keeping more flat for the moment.

It is still early in the day but after closing at record highs yesterday, is there going to be a bit of a fizzle – similar to what we saw after the Pfizer news last week?

The more tepid tones above is keeping major currencies more guarded to start the day with narrower ranges still prevailing. EUR/USD is trading within a 16 pips range between 1.1851 and 1.1867 while USD/JPY is little changed close to 104.50.

For the former, there are large expiries seen @ 1.1850 and 1.1900 today so that could very well keep price action in-check before they roll off later on in the day.

Elsewhere, AUD/USD is little changed with price still holding below near-term resistance closer to 0.7340 and NZD/USD is still tinkering around the 0.6900 handle to start the day.

In other news, just be aware that the S&P 500 is about to get more tech-ish starting from 21 December as Tesla will be joining the index and account for ~1% of the index.

That is likely to lead to a flurry of index rebalancing in the coming days/weeks, with S&P stating that index funds will have to sell about $51 billion worth of shares of companies already in the S&P 500 and use that money to buy Tesla to correctly reflect the index.

Dow and S&P close at record levels

Dow approaches 30 K

The Dow and S&P index both closed at record levels. The NASDAQ index is still off its record high level as investors move into the more beaten-down stocks of 2020.

- Dow post 1st record close since February

- Russell 2000 also closed at a record high level

- Dow closes 48 points from the 30,000 milestone level

The final numbers are showing:

- S&P index up 41.82 points or 1.17% at 3626.96

- NASDAQ index up 94.84 points or 0.80% at 11924.12

- Dow industrial average up 471.29 points or 1.6% at 29951.10

The biggest Dow gainers today included:

- Boeing, +8.17%

- Chevron, +7.19%

- Disney, +4.6%

- Honeywell, +3.52%

- Walgreen boots, +3.25%

- American Express, +3.24%

- J.P. Morgan, +2.89%

- DuPont, +2.87%

- Cisco, +2.78%

- 3M, +2.4%

Four stocks in the Dow industrial average fell on the day including:

- Procter & Gamble, -1.23%

- Merck and Company, -1.1%

- Amgen, -0.29%

- Verizon, -0.25%