Archives of “US Market” category

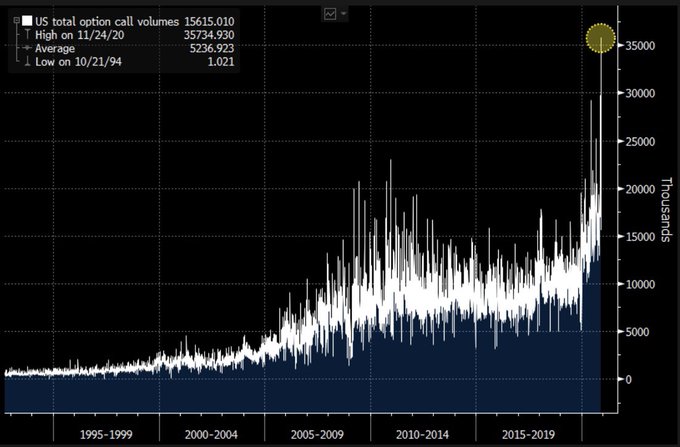

rssWow. Last week, just before the Thanksgiving holiday, more than 35 million call options traded — a record

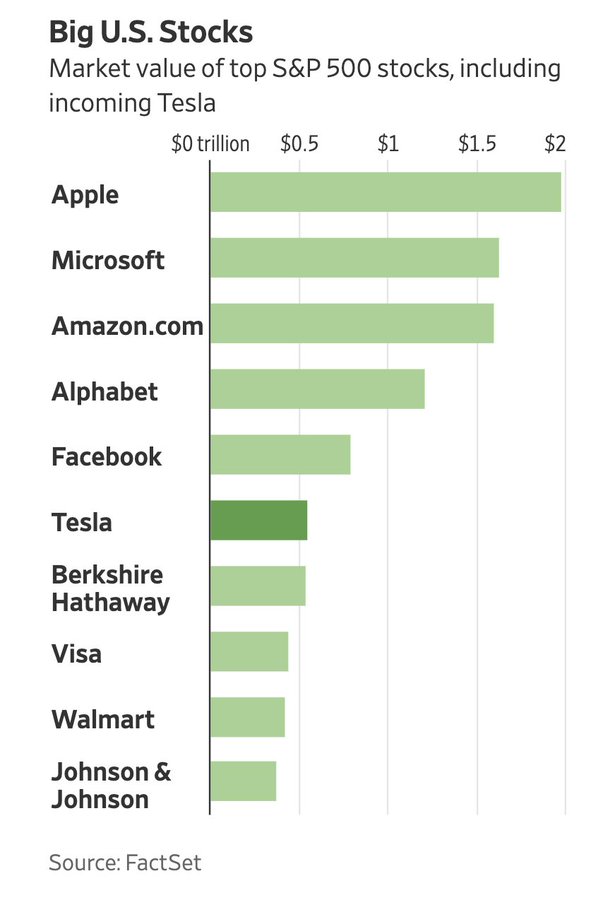

“Tesla’s debut on the S&P 500 in December will kick-start $ 100 billion in trading as fund managers are forced to book stocks.”

An Update : DOW ,SPX500 ,NASDAQ Composite ,FTSE100 ,CAC ,DAX ,NIKKEI ,Bovespa -Anirudh Sethi

To read more enter password and Unlock more engaging content

An Update : #FAANG #TSLA #ZM #MSFT #CSCO #AMD -Anirudh Sethi

To read more enter password and Unlock more engaging content

NASDAQ/S&P close at record high levels

Major indices close higher on shortened post Thanksgiving trading session

The major indices are closing higher with each posting weekly gains.- 4 day win streak for NASDAQ

- NASDAQ closes at record highs

- S&P index close at a record level

- Dow industrial average on track for its best month since 1987

- The S&P index close at a record level

- The NASDAQ has had a 45 record closes in 2020

A look at the final numbers shows:

- S&P index rose 8.76 points or 0.24% at 3638.39

- NASDAQ index closed up 111.44 points or 0.92% at 12205.24

- Dow industrial average rose and 37.9 points or 0.13% at 29910.32

For the trading week, the NASDAQ index led the major indices.

- S&P index, +1.58%

- Dow industrial average +1.45%

- NASDAQ index +2.53%

If you look at the small cap Russell 2000, it had the biggest gain amongst broad market indices. It rose by 3.92%

JPMorgan’s S&P target is 4500 (year-end 2021)

A quickie from a JPM note on the US equities.

Looking for much greater gains, citing:

- Expectations of many key risks subsiding (e.g. U.S. elections, pandemic and vaccine news, etc.) clearing the path to a more positive forward outlook”

- While there has been some upward pressure on rates, central bank policy continues to be accommodative and a major pillar of support for equity multiples.

JPM are wary on a rise in yields though, saying a 1.5% 10-yr UST yield would make them less comfortable on US stocks.

S&P 500, Dow pull back from all-time closing highs after grim jobless data

The S&P 500 index closed lower on Wednesday as mounting U.S. layoffs in the wake of new mandated lockdowns to contain surging COVID-19 infections dampened investor risk appetite.

The market appeared to be replaying the previous two weeks, which began with rallies driven by promising vaccine news but pivoted back to stay-at-home plays on near-term pandemic realities and lack of new fiscal stimulus.

Still, the vaccine developments and removal of uncertainties surrounding the U.S. presidential election have driven Wall Street indexes to record closing highs, and put the S&P 500 on course for its best November ever.

Market participants believe U.S. stocks have more room to climb. A recent Reuters poll showed analysts believe the S&P 500 will gain 9% between now and the end of 2021. The index has surged about 66% since the coronavirus-led crash in March and is up about 12% so far this year.

The Dow Jones Industrial Average fell 173.77 points, or 0.58%, to 29,872.47; the S&P 500 lost 5.76 points, or 0.16%, to 3,629.65; and the Nasdaq Composite added 57.08 points, or 0.47%, at 12,094.40.

Of the 11 major sectors of the S&P 500 seven ended the session in the red, with energy suffering the largest percentage loss.

The economically sensitive banking sector lost ground, with the S&P 500 Banks index shedding 0.7%.

Analysts tipping a further rise for the Dow

Via Reuters polling, analysts looking for more gains on the back of the release of a COVID-19 vaccine driving an economic and corporate earnings recovery from the pandemic

Forecasts:

- S&P 500 will finish 2020 at 3,600

- S&P 500 will finish 2021 at 3,900

- Dow Jones industrial average will finish 2021 at 32,500

Reuters poll of 40 strategists over the last two weeks.

More:

- S&P 500 earnings to jump 23% in 2021

- expectations the Fed will remain accommodative

- “The Fed has said they intend to keep short rates grounded at zero through at least 2023. With ultra low rates, stocks have little competition”

—-

On the Fed and 2023 … I would not be banking on this, if there is a sniff of better data (there already is) and higher inflation (not yet) the Fed will find an excuse to hike.

Although, for now:

Dow and S&P close at record highs. Dow 30,000.

Russell 2000 closes at a record high as well

The Dow, S&P and Russell 2000 all closed at record levels for the day. Moreover, the Dow 30 close above the 30K level for the first time ever.

The S&P had the best day in 3 weeks.

The final numbers are showing:

- S&P index up 57.84 points or 1.62% to 3635.42

- Nasdaq up 156.15 points or 1.31% to 12036.78

- Dow rose 454.97 points or 1.54% to 30046.24

- United Airlines, +9.87%

- American Airlines, +9.29%

- Wells Fargo, plus a .78%

- Exxon Mobil, +7.51%

- Citigroup, +7.04%

- Tesla, +6.52%

- Delta Air Lines, +6.37%

- Bank of America, +5.82%

- Morgan Stanley, +5.51%

- PNC financial, +4.83%

- J.P. Morgan, +4.63%

- Walt Disney, +3.78%

Some losers today included:

- Chew -2.71%

- Goodrx, -2.59%

- Rackspace, -2.4%

- Square, -2.21%

- Nvidia, -1.39%

- Chipotle, -1.39%

- Slack, -1.2%

- Amgen, -0.87%

- General Mills, -0.74%

- Zoom, -0.6%

- Micron, -0.34%

- Procter & Gamble, -0.32%

- AMD, -0.29%