Archives of “US Market” category

rssIs the S&P 500 expensive? Not for the Fed.

Bubbles are easy to see when a logarithmic scale is not used.

US equity close: Mixed picture in US equities

Closing changes for the main markets:

- S&P 500 down 12 points to 3841 (-0.3%)

- DJIA -0.6%

- Nasdaq +0.1%

- Russell 2000 +1.2%

That’s a strange dynamic. It was neither tech nor large caps leading but small caps managed to clock a big gain.

On the week:

- S&P 500 +1.2%

- DJIA 0.0%

- Nasdaq +3.3%

- Russell 2000 +2.1%

US stocks close mixed. S&P and NASDAQ record closes. Dow down on the day

Russell 2000 index also lower

The US stocks are closing mixed with the Dow down, the S&P near unchanged and the Nasdaq higher. The small cap Russel 2000 also closed lower on the day.

All indices closed at records yesterday. The close higher in the S&P and NASDAQ are therefore new record closes today.

The final numbers are showing:

- S&P index up 1.22 points or 0.03% at 3853.07

- NASDAQ index up 73.666 points or 0.55% at 13530.91

- Dow down 12.37 points or -0.04% at 31176.01.

- Russell 2000-11.96 points or -0.55% at 2148.66

Some big gainers today included:

- Airbnb, up 11.54%

- Intel, up 6.48%. They announced earnings before the close which was a surprise

- Ford Motor +6.12%

- First Solar, +5.58%

- Nvidia, +3.7%

- Apple, +3.68%. Apple closed at a new all time record

- Western Digital, +3.26%

- AMD, +3.12%

- Travelers, +2.61%

- Boston Scientific, +2.37%

- Corsair, +2.22%

- Facebook, +2.03%

- Micron, +1.81%

- PayPal +1.78%

- Good RX, +1.72%

- Home Depot, +1.68%

some losers today included:

- Alcoa, -12.41%

- US steel, -7.12%

- United Airlines, -5.73%

- Schlumberger, -4.62%

- DuPont, -3.89%

- Chevron -3.56%

- Square, -3.21%

- Bristol-Myers Squibb, -3.11%

- General Electric -2.72%

- Worthington industry’s, -2.72%

- Exxon Mobil, -2.57%

- Nucor -2.39%

- Bookings.com -2.31%

- CROWDSTRIKE holdings, -2.3%

- Delta Air Lines, -2.23%

- Citigroup, -2.18%

- Walgreens, -2.14%

- AliBaba, -2.12%

- American Airlines -2.04%

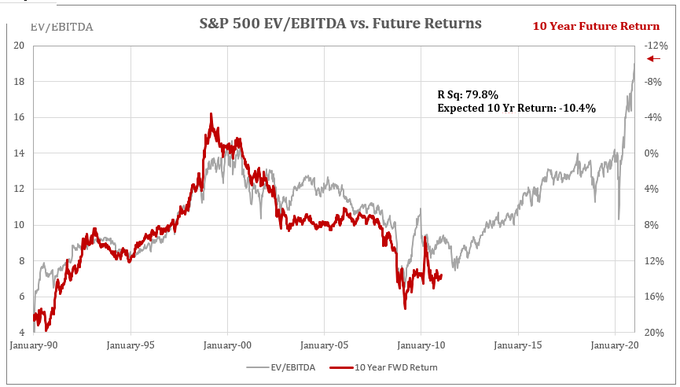

The EV / Ebitda valuation indicates a return of -10.4% per annum for the next 10 years.

US stocks close sharply higher and at record high levels

S&P, Dow and NASDAQ closed at record levels

The major indices all closed at record levels on Inauguration Day for President Biden. The NASDAQ index led the way with a 2% gain. Netflix led the charge with a gain of 16.85% after their subscriber base surprise the upside. Other FAANG type names also rose sharply. Alphabet was up 5.36%. Amazon rose by 4.57%. Microsoft increased by 3.59%. Apple increased by 3.29%. Facebook increased by 2.44%

The final numbers are showing:

- S&P index rose 52.941.39 percent to 3851.05. The low reached 3816.22. The high was at 3859.75.

- The NASDAQ index increased 260.07 points or 1.97% to 13457.25. The high reached 13486.13. The low extended to 13329.77

- The Dow rose 257.86 points or 0.83% to 31188.38. The high reached 31235.98. The low extended to 30997.79. The old all time high close was at 31097.97

- The Russell 2000 index is also trading at a record high level of 2160.617. That’s up 9.48 points or 0.44%

Other big gainers today include:

- Ford motor, plus a .43%

- Alibaba, +5.59%

- Chipotle +3.67%

- Twitter, +3.61%

- Microsoft, +3.59%

- write 8, +3.44%

- Delta Air Lines, +3.25%

- salesforce, +3.10%

- Adobe, +2.85%

- Southwest a or, +2.75%

So far this year, the most short-selling stocks have risen the most.

The S&P 500 was up 68% during Trump’s term

US major broad indices close with solid gains

Dow rises modestly

The US major broad indices closed solidly higher on the day.

The gains were led by the Nasdaq index which rose by 1.53%. A look at the closing numbers shows:

- S&P index rose 30.66 points or 0.81% to 3798.93

- Nasdaq index rose 198.67 points or 1.53% 13197.30

- The more narrowly focused Dow 30 index rose by 116.26 points or 0.38% to 30930.51.

- The Russell 2000 small Index rose 26.79 points or 1.26% to 2150

Highlights:

- Dow rises for the first time in 4 days (3 day losing streak)

- S&P and NASDAQ index snapped a two day slide

After the close Netflix reported

- Streaming paid net change of 8.51 million users. That was much better than the 6.06 million users estimate.

- Guidance for the 1st quarter is for a net paid change of 6.0 million vs. estimate of 7.45 million

- Revenues came in at $7.13 billion vs. estimate $7 billion

- Earnings-per-share came in at $1.19 vs. $1.39 estimate

- Netflix sees 1st quarter ECB of $2.97 vs. $2.12 estimate

- Say that they will explore ongoing stock buybacks

the stock is is trading sharply higher to $554.32 in after- hour trading. The stock closed at $501.77.