Tech like an anchor on stocks

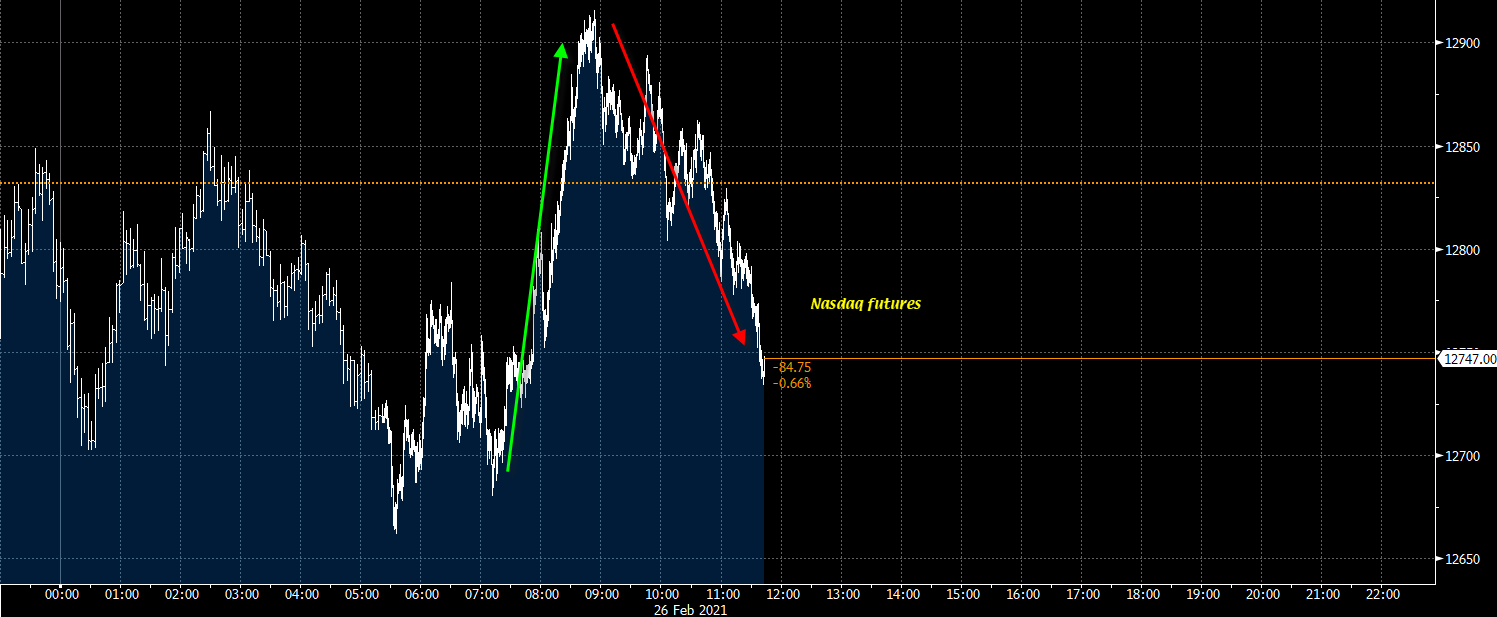

The shape of the US equity selloff continues to be a story unto itself. The Nasdaq plunged 2.7% to finish on the lows while the Russell was down 0.5% and the Dow just 0.4%. Overall, the S&P 500 was down 50 points to 3819, or 1.3%.

The drop today wipes out most of the huge gain on Monday (which was the largest since June).

The trend/wedge is back in the crosshairs ahead of Powell tomorrow. I’m increasingly convinced that he’s going to brush of the rise in yields. If that combines with OPEC+ rolling over cuts, then there’s a great case for higher yields and more pain in stocks.