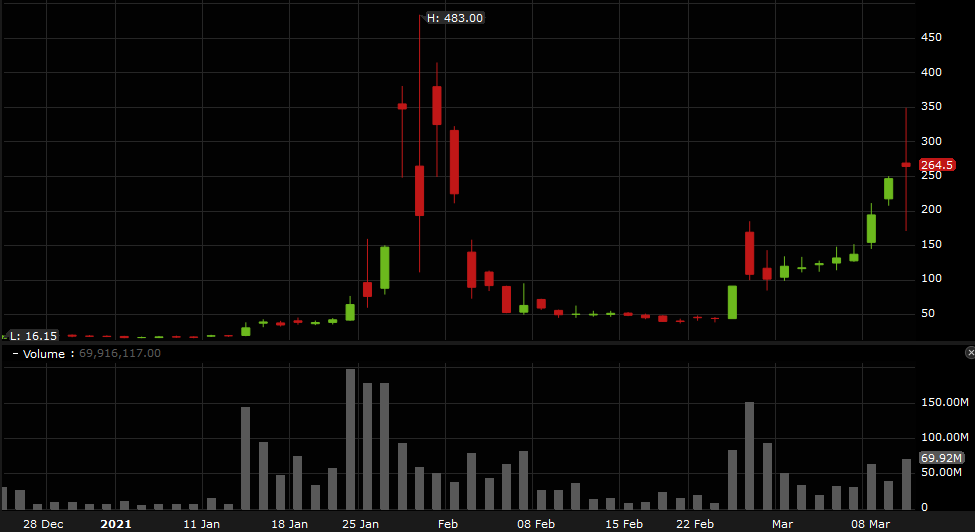

Seems legit… Good luck on This casino.

Year to date:

The S&P, Dow and Russell 2000 all closed at record levels today. The Nasdaq index led the way to the upside, but is still 5 1/2% away from it all time high.

The longs in the technology stocks continue to get hammered and the rotation into the cyclical continues as fears of interest rates have traders repricing the high flyers of 2020.

It was another wild day in the equity complex.

The major indices tumbled once again with the NASDAQ and Russell 2000 index leading the way to the downside. Feds Powell’s interview with the Wall Street Journal did not help hope that the Fed chair would look to talk down (or act on) the higher long-term rates. That did not happen.