Dow the worst performer

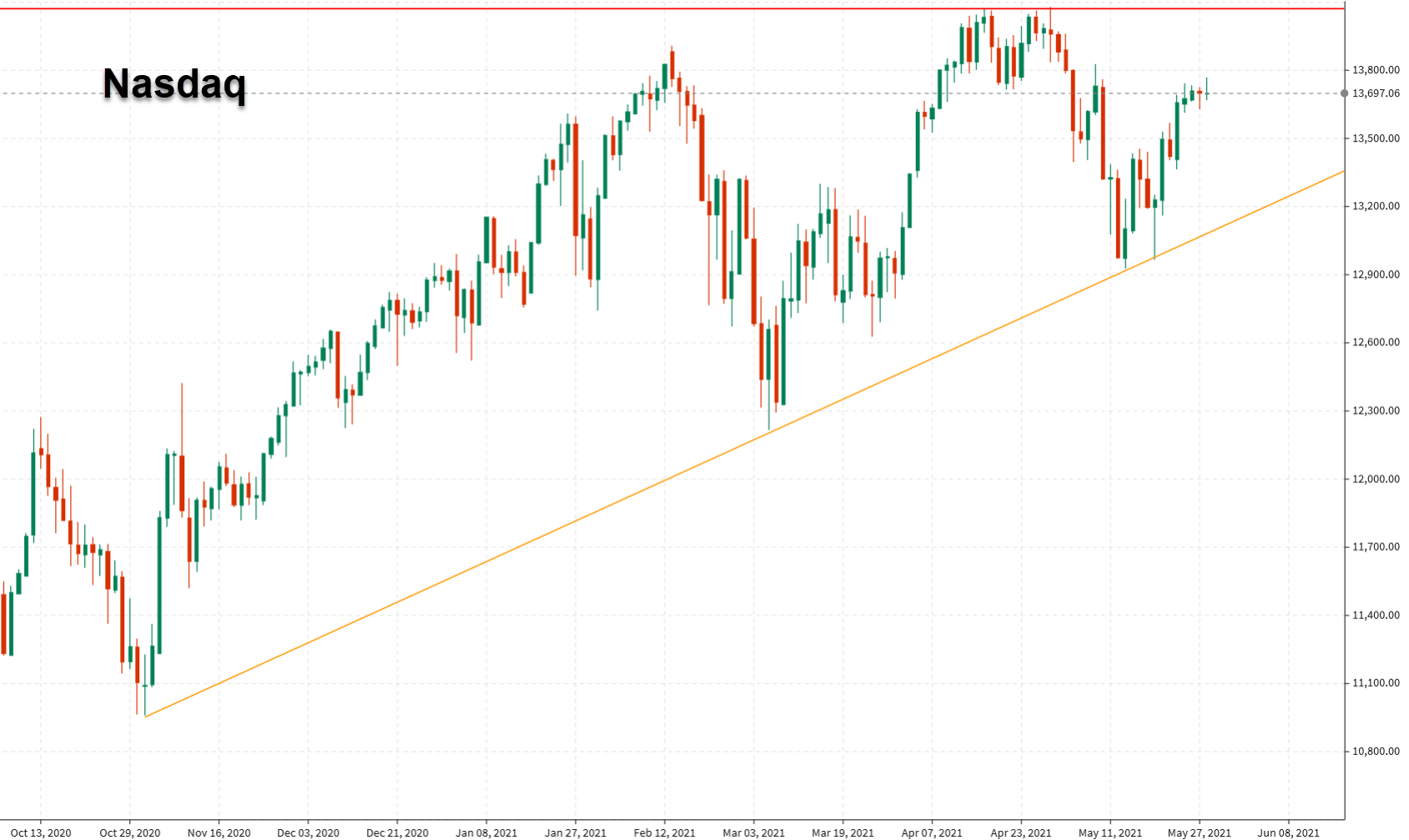

The major indices lost steam and moved lower in the last hour of trading.

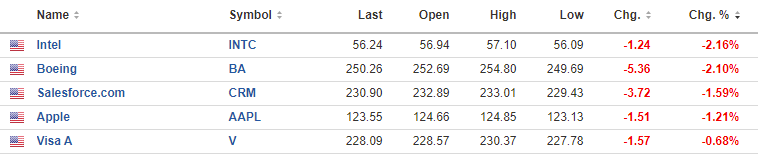

- NASDAQ composite index closes lower for the first time four days

- NASDAQ 100 close higher for the fourth straight day

- Dow has its worst performance in three weeks

- Dow posts a three-day losing streak

- S&P closes lower for the second time in three days. Fails to stay above the all-time high closing level

A look at the major indices shows:

- S&P index fell -7.64 points or -0.18% at 4219.82

- NASDAQ index fell -13.16 points or -0.09% at 13911.75

- Dow felt -153.01 points or -0.44% at 34446.81.

The small-cap Russell 2000 index closed down -16.62 points or -0.71% at 2327.14.