US stocks cemented their biggest weekly gain in more than three months and Treasuries rallied following a patch of soft economic data, all against a backdrop of hopes of progress in US-China trade negotiations.

Wall Street’s S&P 500 resumed its rally, up 0.5 per cent, after a slip on Thursday interrupted a three-day winning streak. The benchmark was up 2.9 per cent this week, its biggest weekly advance since late November.

The S&P has registered a weekly decline just twice this year, as trade optimism and the Federal Reserve’s pledge to be patient on rate rises have lifted sentiment on Wall Street.

“Next week’s FOMC meeting and a potentially pending resolution to trade frictions between the U.S. and China are likely the macro drivers to watch going forward,” Anthony Saglimbene, global market strategist at Ameriprise, wrote to clients.

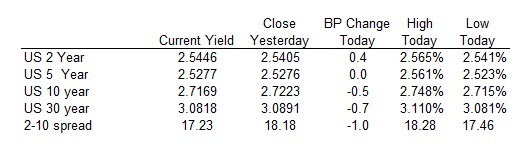

US Treasuries also rallied on Friday, dragging yields lower, following a batch of soft economic data, including industrial production that missed expectations and a gauge of manufacturing activity in New York falling to a 22-month low. Yields on the 2- and 10-year Treasury hit their lowest since early January.

Partly hobbled by a resurgent British pound, the US dollar shed about ¾ of 1 per cent this week for its biggest weekly drop since the first week of December.

Chinese state media on Friday reported “substantive progress” on trade talks and Beijing passed a new foreign investment law designed to smooth the way to a new trade deal with the US.

The CSI 300 index tracking Shanghai and Shenzhen stocks closed up 1.3 per cent.

There were solid moves in Europe. Frankfurt’s Xetra Dax 30 gained 0.9 per cent, gathering pace as the session developed and reaching its highest level since October. London’s FTSE 100 was up 0.6 per cent.