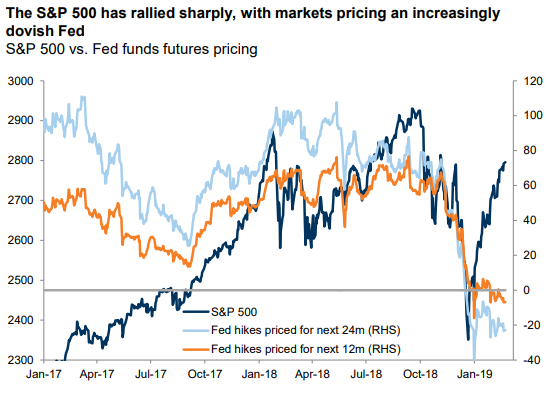

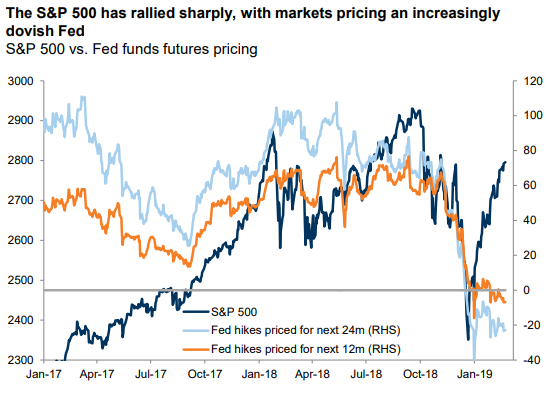

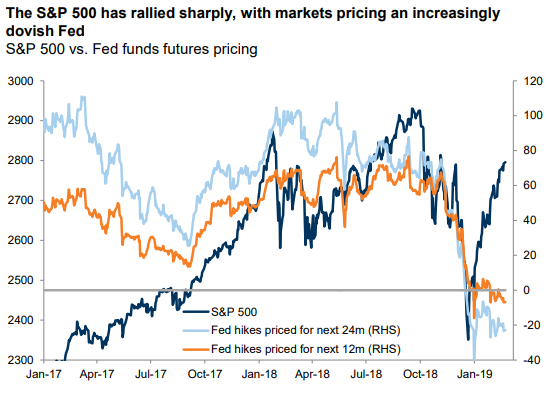

Fed hikes vs. $SPX

Lower liquidity means that the same volume has greater price impact. Fasten your seatbelts. Turbulence ahead.

US stocks rose sharply on a boost from the technology sector, while sovereign debt and the US dollar also rallied as investors digested a dovish shift at the Federal Reserve.

The S&P 500 was 1.1 per cent higher. The Dow Jones Industrial Average climbed 0.8 per cent, and the tech-heavy Nasdaq Composite surged 1.4 per cent.

The broad rally came one day after the Fed signalled no rate rises this year, bringing its projections more in line with market expectations. Policymakers raised rates four times last year and forecast two additional rate rises for 2019 as recently as December.

The central bank also said it will slow the monthly reduction of its Treasury holdings starting from May with a cut from $30bn to $15bn, and will cease trimming its balance sheet in September — prompting economists at Bank of America to note the Fed has completed its 180-degree turn.

Financials were the lone sector in the red, while technology shares advanced 2.5 per cent on the day. The real estate and consumer discretionary sectors also fuelled the market’s lurch higher.

US government debt remained in demand, pushing yields lower early in the session, after a rally around the Fed announcement. The yield on the 10-year Treasury was mostly unchanged at 2.5369 per cent, after earlier touching a fresh 15-month low.

Investors also moved into eurozone debt, pushing the 10-year German Bund yield back towards zero, down 3.5 bps to 0.047 per cent.

London’s FTSE 100 outperformed wider European equities benchmarks with a rise of 0.9 per cent, helped by sustained pressure on the pound — down a further 0.7 per cent to $1.3101 — as investors tracked the UK’s fraught domestic politics.

With the Brexit deadline looming and no clarity on any extension to it, investors moved into the relative safety of UK government debt and at a faster pace than the rally for its eurozone neighbours. The yield on 10-year gilts fell as low as 1.052 per cent, touching its lowest level since September 2017.

Losers included: