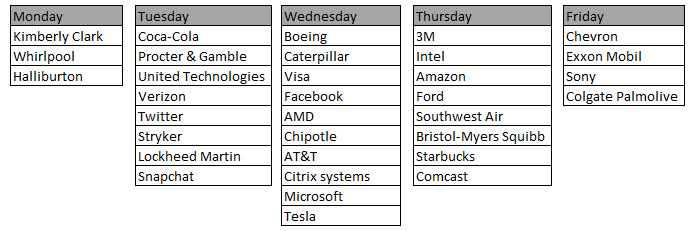

Some selling into the close ahead of lots of data

The US stocks are ending the session lower on the day with modest declines. There were more selling into the close that tipped the indices lower. There a lot of earnings after the close and tomorrow.

The final numbers show:

- S&P down -6.43 points or -0.22% at 2927.25

- Nasdaq fell -18.806 at 8102.01 after making a new all time highs and falling off. The high reached 8139.55.

- Dow fell 59.34 points or -0.22% at 26597.05