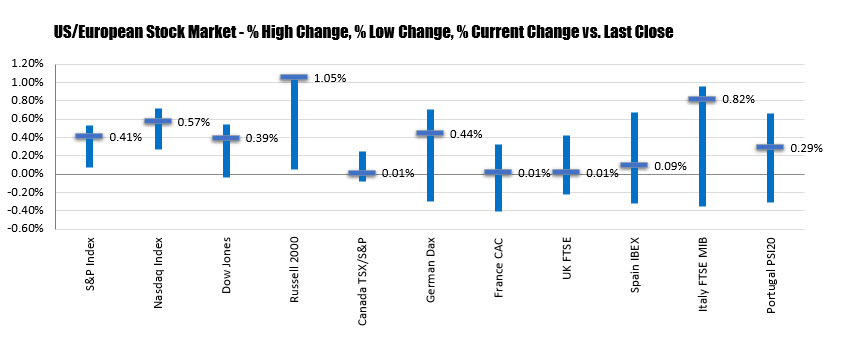

For the week, the major indices end up modest

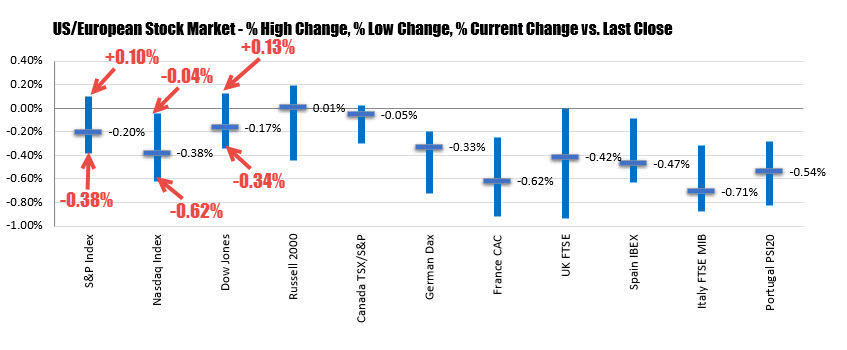

The major US indices are ending the session with losses on the day led by declines in the tech heavy Nasdaq. Chip stocks were hit hard after Broadcom announced worse than expected earnings and forecasts for earnings/sales going forward, blaming tariffs and China.

The final numbers are showing:

- The S&P index closed down -4.65 points or -0.16% at 2886.99. The high reach 2894.45. The low extended 2879.62

- The NASDAQ index fell -40.47 points or -0.52% at 7796.66. The high reach 7819.21. The low extended to 7778.12

- The Dow industrial average fell -17.16 points or -0.7% at 26089.61. The high reached 2612.28. The low extended 25988.09

For the week:

- The S&P index rose 0.47%

- The NASDAQ composite index rose 0.70%

- The Dow industrial average rose 0.41%

Technically, the S&P index S&P index was able to remain above its 50 day MA at 2873.94 for each of the trading days. That’s the bullish news. The not so bullish news is that the market did not exactly race higher this week (see white MA line on the chart below).