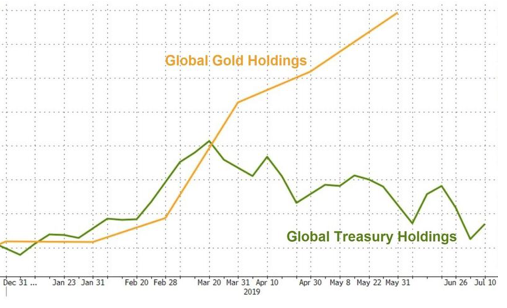

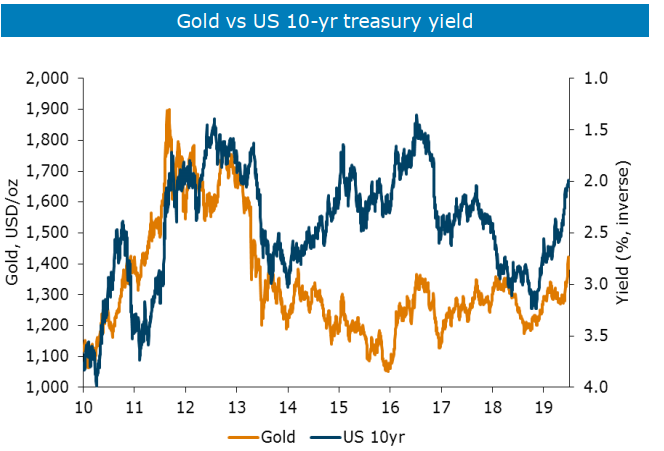

Interesting chart in gold

Gold is suffering on uncertainty about the likelihood of Fed cuts. A July 31 is still almost 100% priced in but the odds of 2, 3 and 4 cuts in the year ahead are falling and that’s taken gold with it.

At the same time, the rally in gold is largely about the global easing cycle and the ECB has left little doubt that it’s going to cut, while the BOE has signaled an openness to lowering rates.

Technically, you can see the uncertainty in gold. It’s formed a bit of a double top and is now feeling out last week’s low. I think a break in either direction is one to go with.